Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

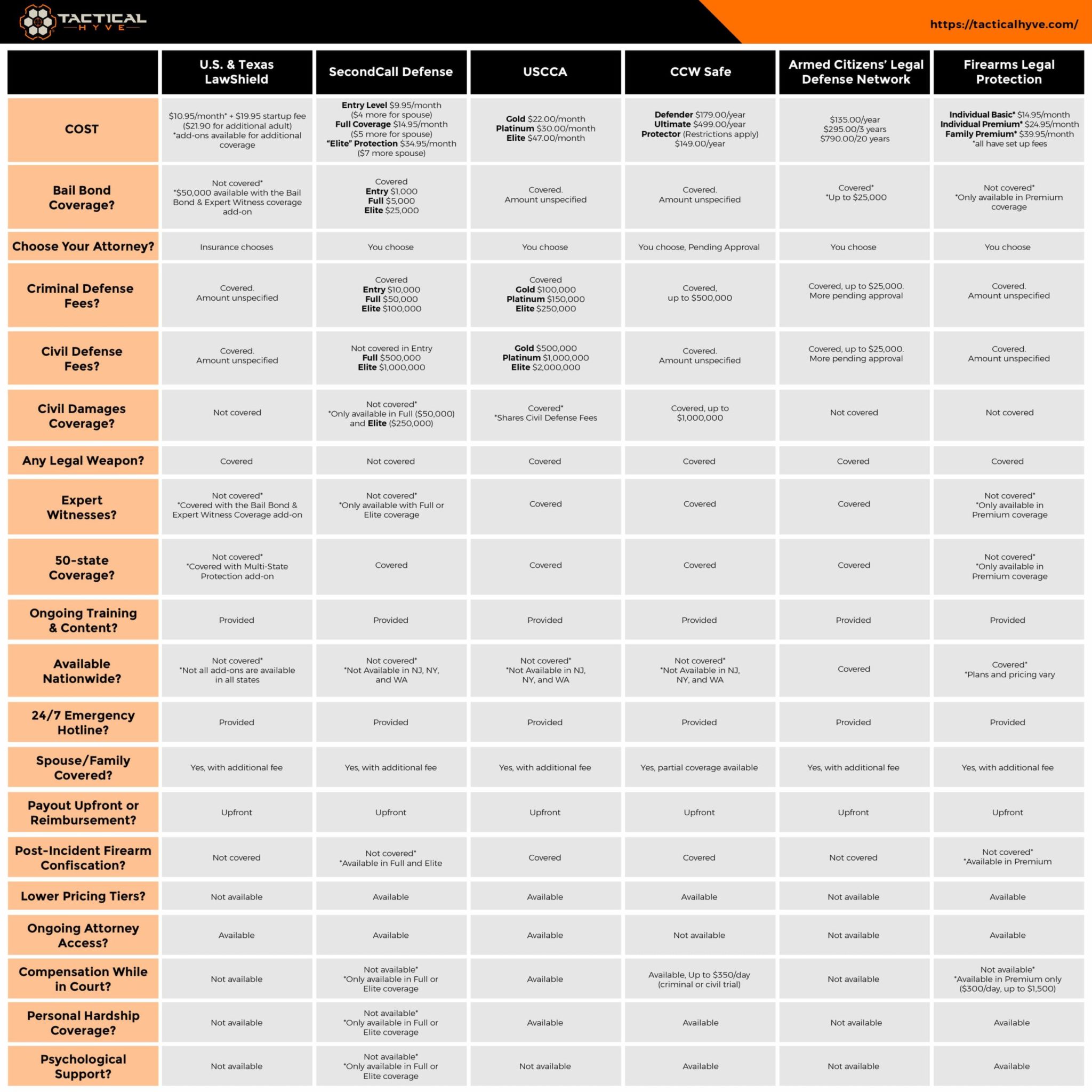

Insurance Showdown: Who's Got Your Back?

Uncover the ultimate insurance face-off! Discover who truly has your back and make informed choices for your future today!

Understanding the Basics: How Different Types of Insurance Protect You

Understanding the basics of insurance is crucial for anyone looking to safeguard their assets and financial future. Different types of insurance serve distinct purposes, providing protection against various risks. Some of the most common types include health insurance, which covers medical expenses; auto insurance, which protects you against vehicle-related risks; and homeowners insurance, which offers coverage for your property and belongings. Each of these policies plays a vital role in mitigating financial loss during unforeseen circumstances.

When exploring the different types of insurance, it's important to consider how they can fit into your overall financial strategy. For instance, life insurance ensures that your loved ones are financially secure in the event of your untimely passing, while disability insurance protects your income if you become unable to work due to illness or injury. Additionally, liability insurance can help shield you from legal claims if you are found responsible for accidents or damages. Ultimately, understanding these options empowers you to make informed decisions and select the coverage that best meets your needs.

Top 5 Factors to Consider When Choosing Your Insurance Provider

Choosing the right insurance provider is crucial to ensure you're adequately covered in times of need. Here are the top 5 factors to consider when making your decision:

- Reputation and Reviews: Research online reviews and seek recommendations from friends or family to gauge the provider's reliability.

- Coverage Options: Ensure the insurer offers a variety of policies that suit your specific needs.

- Pricing: Compare rates from multiple providers, but remember that the cheapest option may not always offer the best coverage.

Continuing with our list, consider these additional factors:

- Customer Service: Evaluate the quality of customer support, as responsive service can make a significant difference during a claim.

- Financial Stability: Check the insurer's financial health through ratings from agencies to ensure they can pay out claims in the future.

Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misconceptions abound, leading to significant mistakes in coverage decisions. One prevalent myth is that having car insurance is sufficient to protect against all potential liabilities. In reality, auto insurance typically covers only liability for damages to others and your own vehicle, but additional policies like umbrella insurance may be necessary for comprehensive protection against expensive lawsuits and significant claims. Understanding the limitations of your policies is crucial for ensuring you’re adequately covered.

Another common misunderstanding is that life insurance is only necessary for those with dependents. However, life insurance can be a valuable financial tool for anyone, regardless of family status. It can cover final expenses, debts, and even serve as an investment vehicle. The earlier you invest in a policy, the lower your premiums tend to be, making it a strategic decision for securing your financial future. Don’t let myths dictate your insurance choices; educate yourself on the real benefits of various insurance products.