Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance Policies: What Your Agent Isn’t Telling You

Uncover the secrets your agent won't share! Dive into insurance policies and protect yourself from hidden risks today.

The Hidden Costs of Insurance Policies: What You Need to Know

When considering insurance policies, it’s crucial to look beyond the premiums and grasp the potential hidden costs that can impact your financial situation. Many policyholders are surprised to find that fees such as deductibles, co-pays, and coverage limitations can significantly affect their out-of-pocket expenses. For instance, a health insurance policy may come with a low premium, but high deductibles and co-pays can lead to exorbitant costs when medical care is needed. Additionally, policies that sound appealing may have restrictions on certain treatments or require prior authorizations, creating unexpected hurdles at critical times.

Another often-overlooked aspect of insurance policies is rate increases. Many consumers are unaware that their premiums can rise annually or following a claim, which may lead to exorbitant costs down the line. It’s essential to review the policy terms thoroughly and understand how factors like claims history and market trends can influence ongoing costs. Failing to account for these hidden fees and potential increases could leave you in a precarious financial situation when you can least afford it. Always ask your insurance agent for clarity on how and when rates might change to avoid any nasty surprises.

5 Common Misunderstandings About Insurance Policies

When it comes to understanding insurance policies, many individuals face common misunderstandings that can lead to confusion and inadequate protection. One prevalent myth is that all insurance policies are the same. In reality, different types of insurance—be it health, home, or auto—come with varying terms, coverage options, and exclusions. It's essential to thoroughly read and compare individual policies to ensure you're selecting the right coverage for your specific needs.

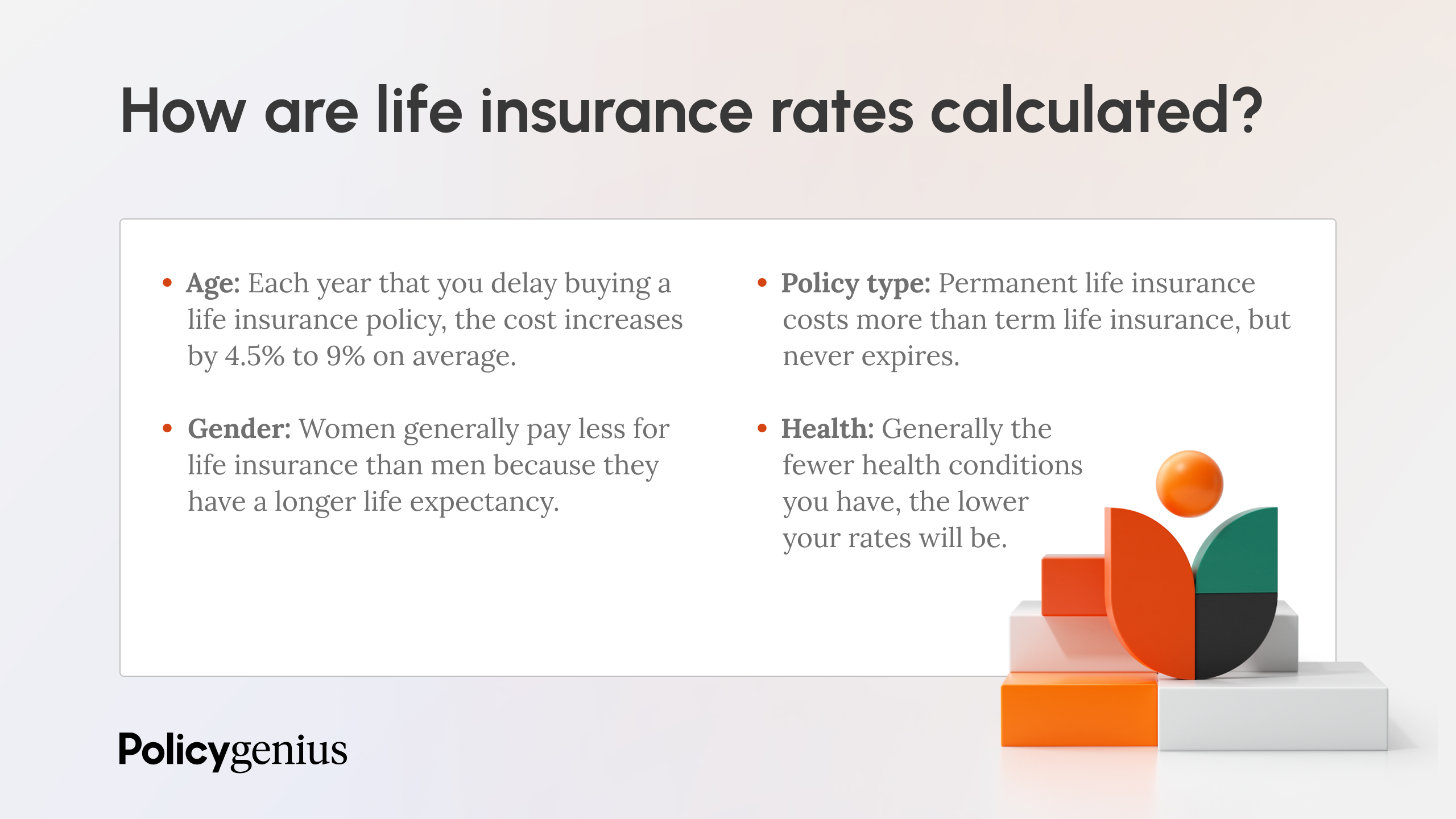

Another frequent misconception is that life insurance is only for older individuals. Many people believe that purchasing life insurance is unnecessary unless they are approaching retirement age. However, securing a policy at a younger age can provide substantial long-term benefits, such as locking in lower premiums and ensuring financial security for loved ones in the event of an unexpected loss. By addressing these misunderstandings, individuals can make more informed decisions regarding their insurance needs.

Is Your Agent Giving You the Full Picture? Uncovering Insurance Myths

When it comes to navigating the complex world of insurance, understanding the truth behind common myths is essential. Many individuals rely on their agents for advice, but are they really giving you the full picture? It's not uncommon for agents to inadvertently perpetuate misconceptions, leading policyholders to make uninformed decisions. For instance, one common myth is that having insurance means you are fully protected. In reality, policies often have exclusions that can leave you vulnerable in key areas. Therefore, it's crucial to ask your agent detailed questions about what is and isn't covered in your policy.

Another prevalent myth is the belief that higher premiums always mean better coverage. Many consumers assume that paying more will guarantee comprehensive protection, but this isn't always the case. It's important to evaluate the specifics of your policy rather than focusing solely on cost. To aid in debunking these myths, consider the following tips:

- Conduct your own research to understand insurance terms and conditions.

- Ask your agent for clarification on any points you find confusing.

- Request comparisons between different policies to assess value and coverage options.