Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance Savings That Will Make You Smile

Discover amazing insurance savings that will brighten your day! Unlock deals and tips to keep more money in your pocket. Smile while you save!

Top 5 Insurance Discounts You Didn't Know Existed

Insurance can be a significant expense for many individuals and families, but you might be missing out on valuable savings. Here are the top 5 insurance discounts you didn't know existed:

- Bundling Discounts: Many insurance companies offer discounts when you combine multiple policies, such as auto and home insurance. This can lead to substantial savings over time.

- Good Student Discounts: If you have a student in your household who maintains a high GPA, you may be eligible for discounts on their auto insurance premiums. This encourages safe driving behavior among young drivers.

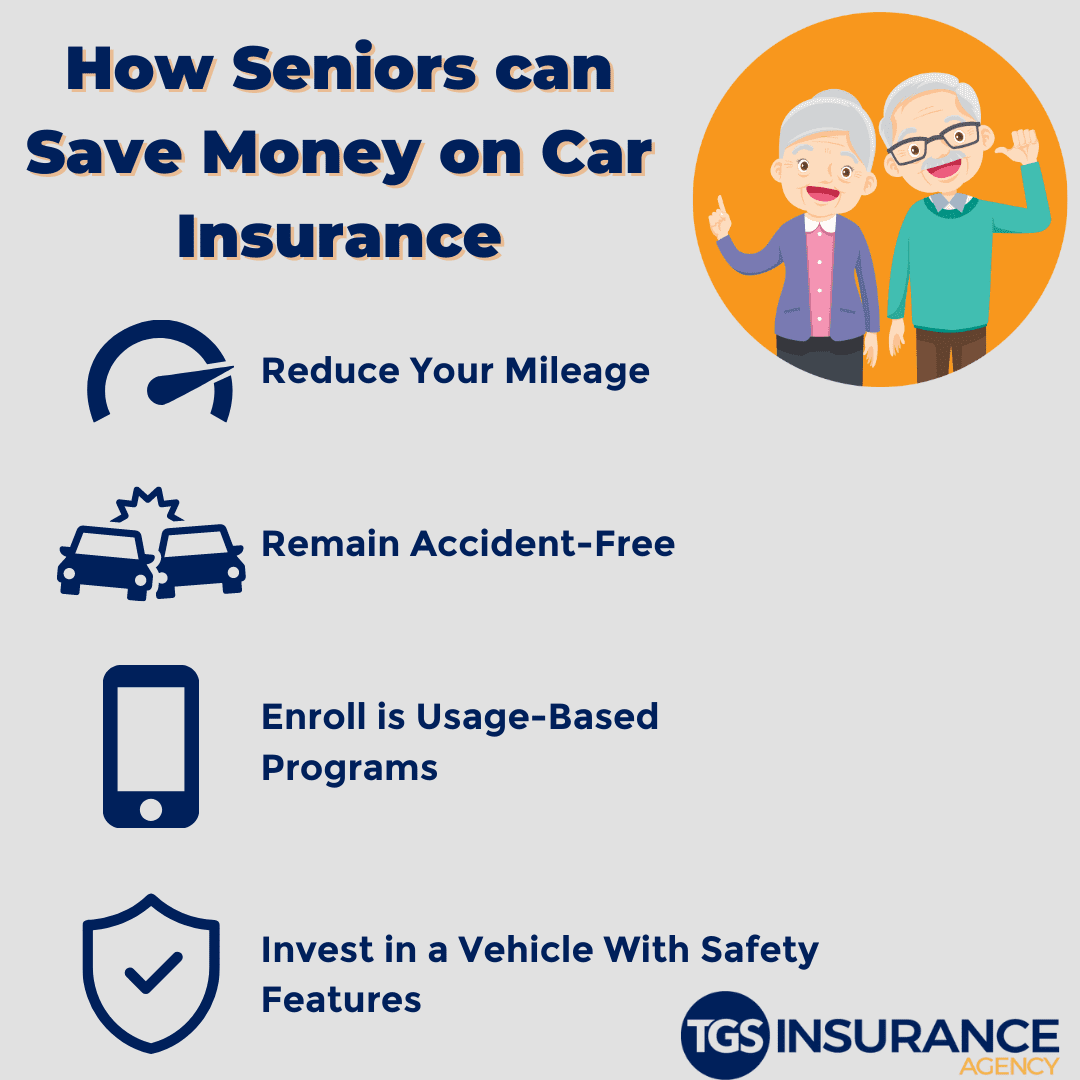

- Low Mileage Discounts: For those who don’t drive often, there are discounts available for low mileage. If you drive under a certain number of miles each year, be sure to inquire with your insurance provider.

- Safety Features Discounts: Vehicles equipped with modern safety features like anti-lock brakes and airbags often qualify for discounts. Investing in safety technology could save you money on insurance premiums.

- Loyalty Discounts: Staying with the same insurance provider for several years can earn you loyalty discounts. Always check if your insurer offers reduced rates for long-term customers.

Understanding these insurance discounts can help you save a significant amount of money without sacrificing coverage. Don't hesitate to ask your insurance agent about other potential savings and to ensure you're getting the best rates available!

How to Save Big on Your Insurance Premiums: Expert Tips

Saving on your insurance premiums doesn't have to be a daunting task. By following a few expert tips, you can significantly reduce your costs while still enjoying adequate coverage. First, compare quotes from different providers. Websites and apps dedicated to this purpose can help you easily see who's offering the best rates. Additionally, consider bundling your policies; many insurers offer substantial discounts when you combine auto, home, and other types of insurance. This can lead to significant savings on your overall premiums.

Another effective way to save is by regularly reviewing your policy and coverage needs. Life changes such as marriage, moving, or even purchasing new valuables may require you to adjust your coverage. Furthermore, increasing your deductible can lower your premium significantly. Just be sure you can afford that deductible in case of a claim. Lastly, don't forget to ask about available discounts. Many companies offer reductions for safe driving records, home security systems, or even being a member of certain organizations. Taking these steps can lead to big savings on your insurance premiums!

Are You Overpaying? Questions to Ask Your Insurance Provider

When reviewing your insurance policy, it's essential to ask the right questions to determine if you're overpaying. Start by asking your provider about the specifics of your coverage. Are there any exclusions or limitations that could affect your claims? Understanding the details can highlight whether you're paying for coverage that you may not need. Additionally, inquire about any discounts that you might be eligible for, such as safe driver discounts, bundling options, or loyalty rewards. These can significantly impact your premium and can help you save money over time.

Another critical area to explore is your premium compared to the value of your coverage. Ask your insurance provider if your current premium reflects the market rates for similar policies. You can also request a breakdown of your premium to identify any areas where you might be paying excessively. Don't hesitate to discuss your current financial situation and any changes that may have occurred since you first purchased the policy. Be prepared to negotiate and consider getting quotes from other providers to ensure you're not overpaying for your insurance.