Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Whole Life Insurance: The Financial Safety Net You Didn't Know You Needed

Discover how whole life insurance can be your unexpected financial safety net and secure your family's future today!

What is Whole Life Insurance and How Does It Work?

Whole life insurance is a type of permanent life insurance that provides coverage for the lifetime of the insured, as long as premium payments are made. Unlike term life insurance, which expires after a specific period, whole life insurance accumulates cash value over time, making it a dual-purpose financial product. This is achieved through a portion of the premiums being invested by the insurance company, leading to a cash value that can be accessed by the policyholder during their lifetime through loans or withdrawals. Additionally, the policy pays out a death benefit to beneficiaries upon the insured's passing, ensuring financial protection for loved ones.

Understanding how whole life insurance works involves recognizing its key components. The premium payments are typically fixed and are scheduled over the lifetime of the policyholder. As the policy matures, the cash value grows at a predetermined rate, which is often guaranteed by the insurer. Policyholders have the option to leverage this cash value for various needs, such as financing education or supplementing retirement income. It is important to note that any outstanding loans against the cash value will reduce the death benefit if not repaid. Thus, while whole life insurance serves as both a safety net and a financial tool, careful management is essential to maximizing its benefits.

5 Benefits of Whole Life Insurance You Might Not Know About

Whole life insurance offers several advantages that often go unnoticed. One significant benefit is the cash value accumulation. Unlike term insurance, whole life policies build cash value over time, allowing policyholders to access funds through loans or withdrawals. This feature can provide financial flexibility, especially during emergencies or when unexpected expenses arise. Additionally, the cash value grows at a guaranteed rate, which can serve as a safe investment option compared to other volatile market instruments.

Another lesser-known benefit is the level premiums characteristic of whole life insurance. With this policy, the premiums are established at the time of purchase and remain consistent throughout the life of the policyholder. This predictability allows for better financial planning, ensuring that premiums won’t increase as the insured ages or faces health issues. Furthermore, whole life insurance can also offer tax advantages, as the death benefit is typically paid out tax-free to beneficiaries, making it a valuable tool for estate planning.

Is Whole Life Insurance the Right Choice for Your Financial Future?

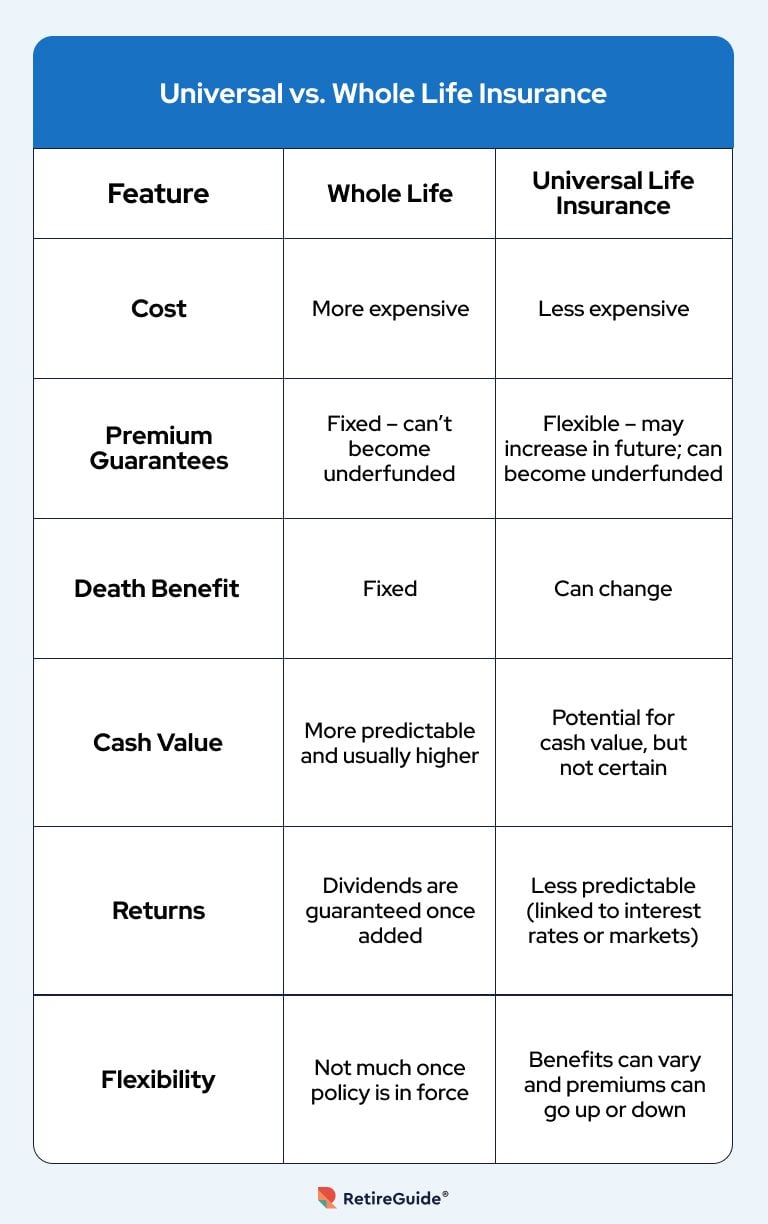

When considering your financial future, it's crucial to evaluate whether whole life insurance is the right choice for you. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection and builds cash value over time. This can serve as a financial asset that you can borrow against or withdraw from in times of need. However, it's essential to weigh the benefits against the higher premiums typically associated with whole life policies. Assessing your long-term financial goals and how these policies fit into your overall strategy is key.

Moreover, whole life insurance can provide a sense of security and peace of mind, knowing that your beneficiaries will receive a death benefit no matter when you pass away. It can also play a role in estate planning, allowing for smoother wealth transfer to heirs. However, it’s important to recognize that whole life insurance may not be suitable for everyone, especially those with limited budgets or those who prefer investing in other avenues. Consulting with a financial advisor can help you determine whether this type of insurance aligns with your financial aspirations and needs.