Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Disability Insurance: Your Safety Net or Just a Safety Myth?

Discover the truth about disability insurance: essential safety net or an illusory safeguard? Uncover the reality now!

Understanding Disability Insurance: Is It Truly a Safety Net?

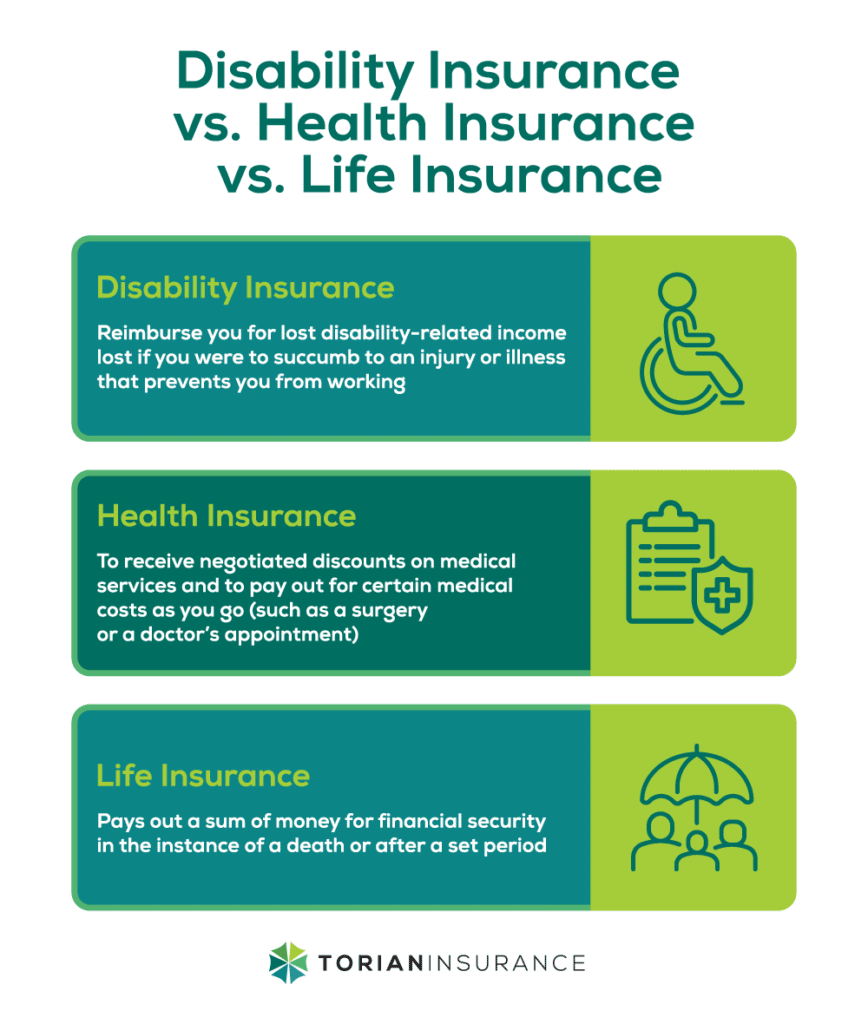

Disability insurance is designed to provide financial support when an individual is unable to work due to an illness or injury. It serves as a crucial safety net that can cover a portion of lost income, allowing individuals to maintain their living standards during challenging times. Understanding the different types of policies available is essential; for instance, short-term disability insurance typically covers a limited duration, often up to six months, while long-term disability insurance can extend benefits for several years or until retirement age. Evaluating your specific needs and occupation can help in selecting the appropriate coverage.

While many view disability insurance as an essential part of financial planning, there are nuances that individuals must consider. For example, group disability insurance offered by employers may not provide enough coverage, leaving a gap that personal policies could fill. Additionally, waiting periods and benefit limits can significantly impact the adequacy of this safety net. It's critical to read the policy fine print and compare options, ensuring that you secure coverage that aligns with your financial goals and potential risks associated with your profession.

Fact vs. Fiction: Debunking Common Myths About Disability Insurance

Disability insurance is often surrounded by myths that can lead to misunderstanding and misinformation. One common myth is that only those in physically demanding jobs need disability coverage. In reality, disability insurance is essential for anyone who relies on their income, regardless of the nature of their work. Accidents and illnesses can affect anyone, and having a safety net can provide peace of mind during uncertain times.

Another misconception is that disability insurance is always too expensive to be worthwhile. While it is true that costs can vary, there are many affordable options available. Understanding your needs and shopping around can reveal plans that fit your budget. Besides, being financially prepared for a potential disability can save you from catastrophic debt. Ultimately, investing in disability insurance is a proactive step toward safeguarding your future.

Do You Really Need Disability Insurance? Key Questions to Ask Yourself

Deciding whether you need disability insurance can be a pivotal choice in your financial planning. It’s crucial to ask yourself a few key questions: Do you have sufficient savings to cover your expenses if you are unable to work for an extended period? What are the potential risks associated with your profession? Understanding your own risk factors and financial safety nets can help clarify the necessity of disability insurance.

Another important aspect to consider is your current obligations. If you have dependents, loans, or other financial responsibilities, the absence of a steady income could have severe implications. Reflect on the following questions:

- How much would your monthly expenses be without your salary?

- Can your family or savings support you during this time?

- Are you currently in a job that is susceptible to disability due to health issues or accidents?