Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Discounts That Drive Down Your Premiums

Unlock hidden discounts that slash your premiums! Discover savvy tips to save big on your insurance today!

Unlocking Hidden Savings: How Discounts Can Lower Your Premiums

Understanding how to unlock hidden savings through discounts can significantly lower your premiums. Many insurance providers offer a variety of discounts that policyholders may not be aware of. Discounts can range from bundling multiple policies—such as home and auto insurance—to maintaining a good driving record or being a loyal customer. By researching the specific discounts available from your insurer, you can often find substantial savings opportunities that directly impact your overall premium costs.

Another way to harness the power of discounts is by taking advantage of safety features or proactive measures that reduce risk, leading to lower premiums. For instance, installing security systems in your home or anti-theft devices in your vehicle can qualify you for additional discounts. Additionally, many insurers offer programs that reward safe driving habits through telematics, providing another avenue for premium reductions. By actively seeking out these options, you can effectively lower your premiums while benefiting from enhanced security and peace of mind.

Top 5 Discounts You Didn’t Know Could Reduce Your Insurance Premiums

When it comes to lowering your insurance premiums, many people are unaware of the discounts that can significantly reduce their costs. Here are the Top 5 Discounts you didn’t know could help your wallet:

- Bundling Discounts: Many insurance providers offer discounts when you bundle multiple policies, such as home and auto insurance.

- Safe Driver Discounts: If you have a clean driving record, you may qualify for a discount that rewards safe driving habits.

- Home Security Discounts: Installing security systems in your home can lead to lower premiums on homeowners insurance.

- Occupational Discounts: Certain professions, like teachers or engineers, can receive exclusive discounts.

- Loyalty Discounts: Staying with the same insurance company for a long period can often lead to loyalty discounts.

What Types of Discounts Are Available to Slash Your Insurance Costs?

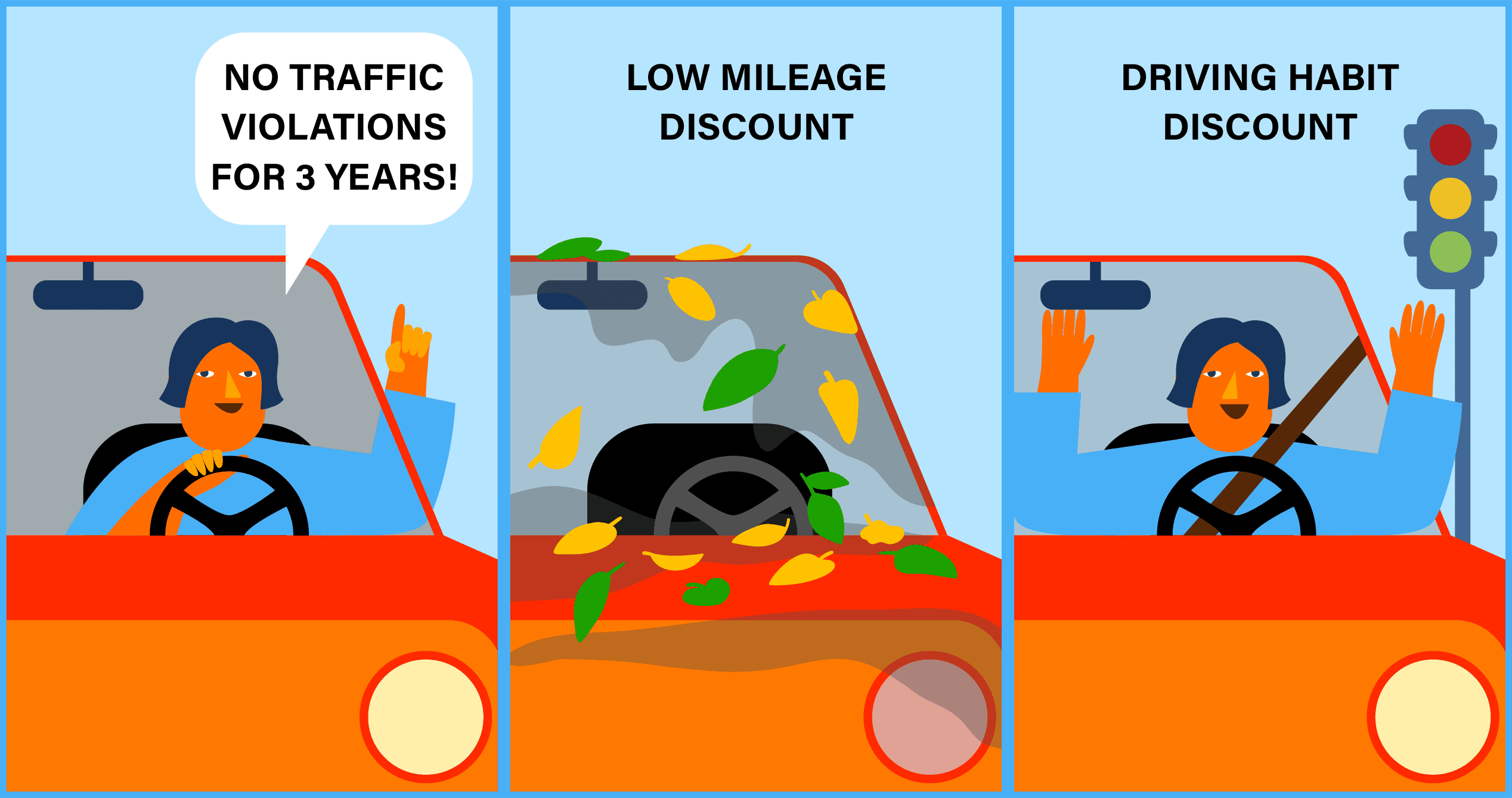

When it comes to managing your insurance costs, understanding the various types of discounts available can significantly lower your premiums. Insurers offer a range of discounts categorized mainly into multi-policy discounts, safe driver discounts, and good student discounts. For instance, bundling your home and auto insurance policies can lead to significant savings. Additionally, if you maintain a clean driving record, your insurer may reward you with a discount for being a safe driver, while students who achieve high grades might also qualify for a good student discount.

Other notable discounts include low mileage discounts, which benefit those who drive fewer miles annually, and pay-in-full discounts for policyholders who choose to pay their premiums in a single lump sum rather than monthly. Some insurers also provide discounts for specific safety features in your vehicle, such as anti-lock brakes and airbags. By taking full advantage of these discounts, consumers can effectively slash their insurance costs and ensure they are not overpaying for their coverage.