Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Drive Smart and Save Big on Your Policy

Unlock huge savings on your insurance! Discover smart driving tips to lower your policy costs and drive away with extra cash in your pocket.

Top 5 Tips to Drive Smart and Lower Your Insurance Premiums

Reducing your insurance premiums can be a game changer for your financial health. Here are top 5 tips to drive smart and lower your insurance premiums:

- Maintain a Clean Driving Record: A history of safe driving is one of the best ways to lower your premiums. Avoid accidents and traffic violations to stay eligible for discounts.

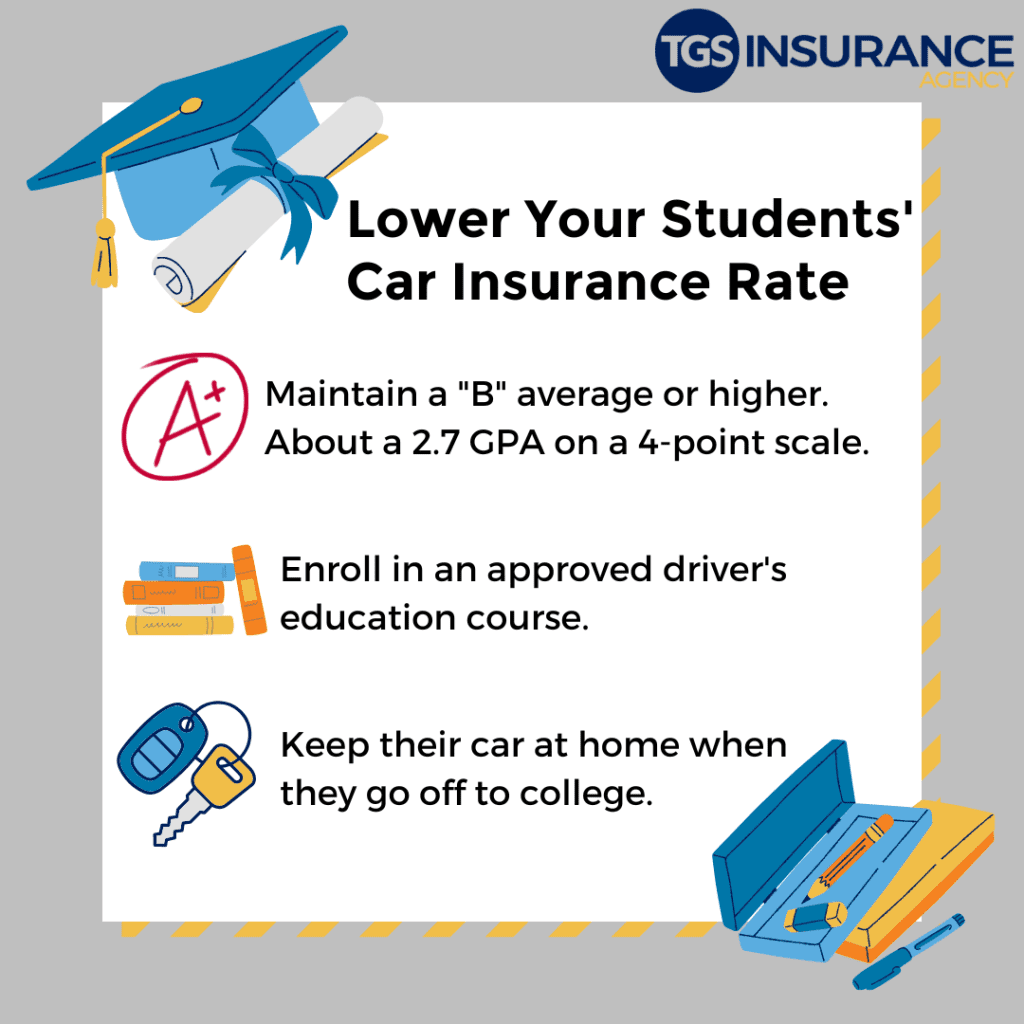

- Take Advantage of Discounts: Many insurance companies offer various discounts for things like bundling policies, good student discounts, or safety features in your car. Always ask about potential savings.

- Increase Your Deductible: Opting for a higher deductible can significantly reduce your monthly premium. Just ensure you have enough savings to cover the deductible in case of an accident.

- Drive a Safer Vehicle: Vehicles with high safety ratings typically result in lower insurance costs. Research your car's safety features and how they impact your rates.

- Review Your Policy Regularly: Annual policy reviews allow you to compare rates and coverage options. You may find better deals or new discounts that weren't available previously.

Understanding the Benefits of Safe Driving: How it Affects Your Policy

Safe driving is not just a personal responsibility; it significantly impacts your auto insurance policy. When you maintain a record of safe driving, you reduce the likelihood of accidents and claims, which are critical factors that insurance companies consider when determining premiums. The benefits of safe driving extend beyond just the immediate safety of yourself and others on the road; they lead to potential discounts on your insurance rates. Many insurers offer incentives for drivers who demonstrate safe habits, which can include maintaining a clean driving record or completing defensive driving courses. As a result, practicing safe driving can save you money while providing peace of mind.

Moreover, maintaining a safe driving record can strengthen your standing with insurance providers. If you ever need to file a claim, a history of safe driving may influence how your insurer views your case. Understanding the benefits of safe driving also means recognizing that a clean record can lead to better coverage options and lower deductibles. Additionally, many states mandate certain safe driving rules, and adhering to these can help drivers avoid legal troubles that complicate insurance claims. In essence, practicing safe driving is not only beneficial for your health and safety but also plays a crucial role in shaping your insurance policy in favorable ways.

Is Your Driving Habits Saving You Money on Your Insurance?

The connection between your driving habits and your insurance premiums is often underestimated. Safe driving habits can significantly lower your insurance costs by demonstrating to insurers that you pose a lower risk. For instance, if you consistently follow traffic rules, avoid aggressive driving, and maintain a clean driving record, you are more likely to qualify for discounts. Many insurance companies offer safe driver discounts, which can lead to substantial savings over time. Furthermore, using apps or devices that track your driving behavior can provide additional incentives for safe practices, often resulting in lower monthly premiums.

On the flip side, poor driving habits can lead to increased insurance costs. Frequent speeding, abrupt braking, and accidents can not only raise your premiums but also affect your insurance eligibility. Insurers heavily weigh your driving history when calculating quotes, meaning a few incidents can have lasting repercussions. To ensure that your driving habits are saving you money rather than costing you, consider adopting defensive driving techniques, participating in driving courses, and regularly reviewing your insurance policy to identify possible discounts. By actively managing your driving behavior, you can turn those savings into a significant financial advantage.