Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance on a Dime: How to Get Coverage Without Breaking the Bank

Discover smart tips to secure affordable insurance without the hefty price tag! Save money and get covered today!

10 Tips for Finding Affordable Insurance that Fits Your Budget

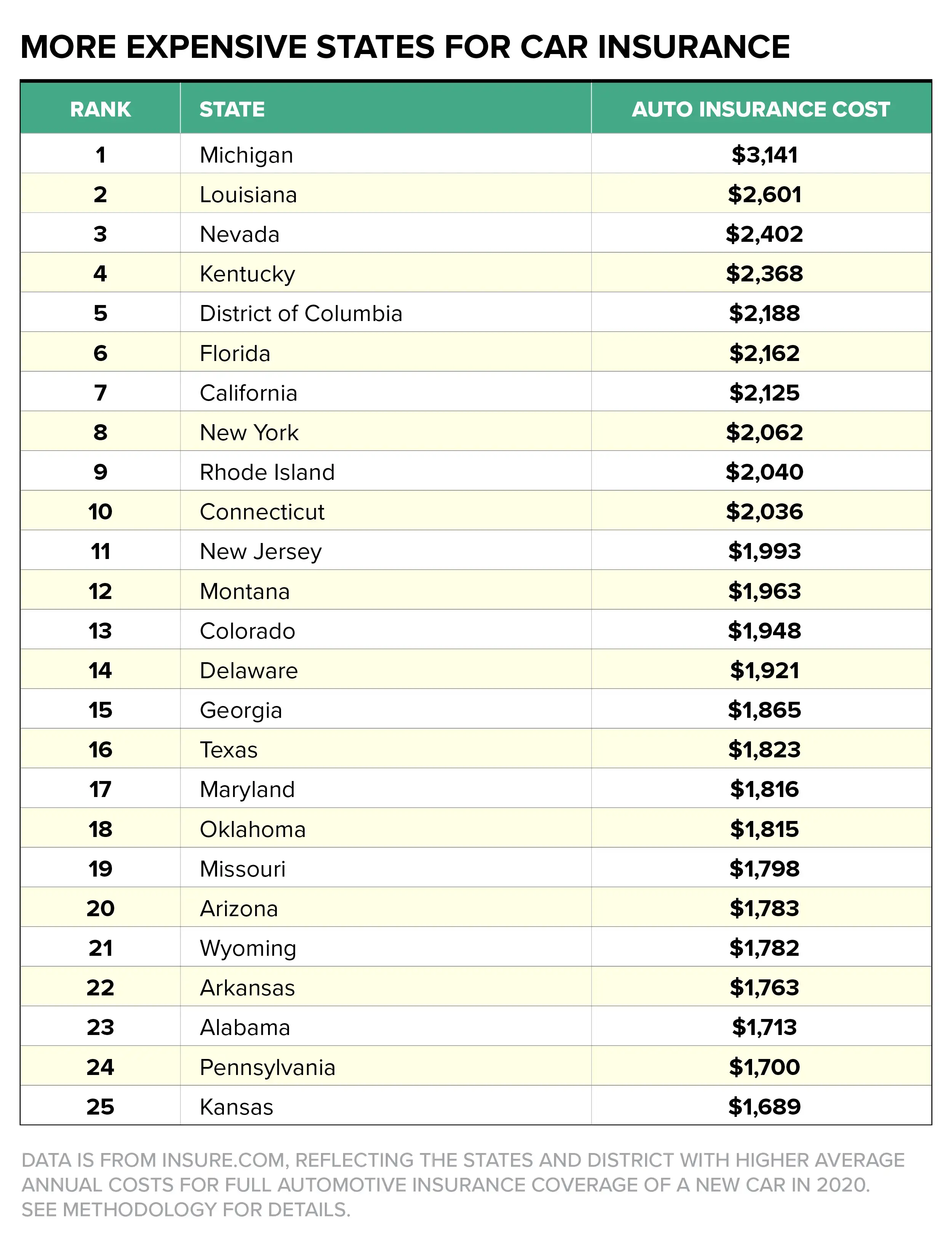

Finding affordable insurance that fits your budget can often feel overwhelming. However, with the right strategies, you can ensure you're getting the coverage you need without breaking the bank. Start by researching multiple providers to compare their rates, coverage options, and customer reviews. Make use of online comparison tools to gather estimates and identify the most competitive prices. Additionally, consider bundling your insurance policies, such as auto and home insurance, as many insurers offer discounts for combined coverage.

Another effective tip is to assess your coverage needs carefully. Understand what you truly need in an insurance policy so you don’t pay for unnecessary add-ons. It's also wise to choose a higher deductible, as this can lower your premium significantly. Lastly, maintain a good credit score as many insurance companies take this into account when determining your rates. By following these tips, you can find an insurance plan that not only offers the necessary protection but also fits within your financial plan.

Understanding Different Types of Insurance: What You Need vs. What You Don't

Understanding the various types of insurance available is crucial for making informed decisions about your personal and financial security. Insurance can be categorized into several essential types, including health insurance, auto insurance, homeowners insurance, and life insurance. Each type serves a unique purpose and caters to different needs. For instance, while health insurance protects you from exorbitant medical costs, auto insurance is vital for safeguarding your vehicle and assets on the road. It's important to assess your personal circumstances and priorities in order to determine which types of coverage are necessary for you.

On the other hand, not all insurance types are created equal, and some may be less relevant to your situation. For example, many people find that they can forgo pet insurance if they do not own a pet, or they may choose to skip travel insurance if they travel infrequently. To make educated decisions, consider the following factors when evaluating your insurance options:

- Your lifestyle and personal circumstances

- Your financial stability and potential risks

- Your obligations to dependents or family members

Is Cheaper Insurance Worth It? Evaluating Coverage Options Without the Cost

When exploring the question of Is cheaper insurance worth it, it’s essential to evaluate the coverage options available rather than solely focusing on the price. Cheaper insurance may seem appealing at first glance, but it can sometimes lead to gaps in coverage that could cost you more in the long run. For instance, if you opt for a budget-friendly health insurance plan, you might find yourself facing high out-of-pocket expenses or limited provider networks, which can compromise your access to quality healthcare.

Before making a decision on whether cheaper insurance is right for you, consider factors such as coverage limits, deductibles, and co-pays. It’s important to conduct a thorough comparison of different policies and evaluate how they align with your individual needs. Take note of any exclusions or limitations in the fine print. In many cases, investing in a slightly more expensive policy may provide you with the necessary coverage and peace of mind that a cheaper option lacks, ultimately proving to be more cost-effective in the event of a claim.