Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance Policies: The Surprising Secret to Peace of Mind

Unlock the surprising truth about insurance policies and discover how they can bring you peace of mind—find out more now!

Understanding Insurance Policies: Key Benefits for Your Peace of Mind

Understanding insurance policies is crucial for anyone looking to protect their financial well-being. These policies provide a safety net against unforeseen events, allowing you to navigate life's uncertainties with confidence. Key benefits of having insurance include financial security, where unexpected costs, such as medical expenses or property damage, can be covered. Additionally, insurance can foster a sense of peace of mind, knowing that you and your loved ones are safeguarded against significant losses.

There are various types of insurance policies available, each designed to address specific needs:

- Health Insurance: Covers medical expenses.

- Auto Insurance: Protects against vehicle damage and liability.

- Homeowners Insurance: Safeguards your home and belongings.

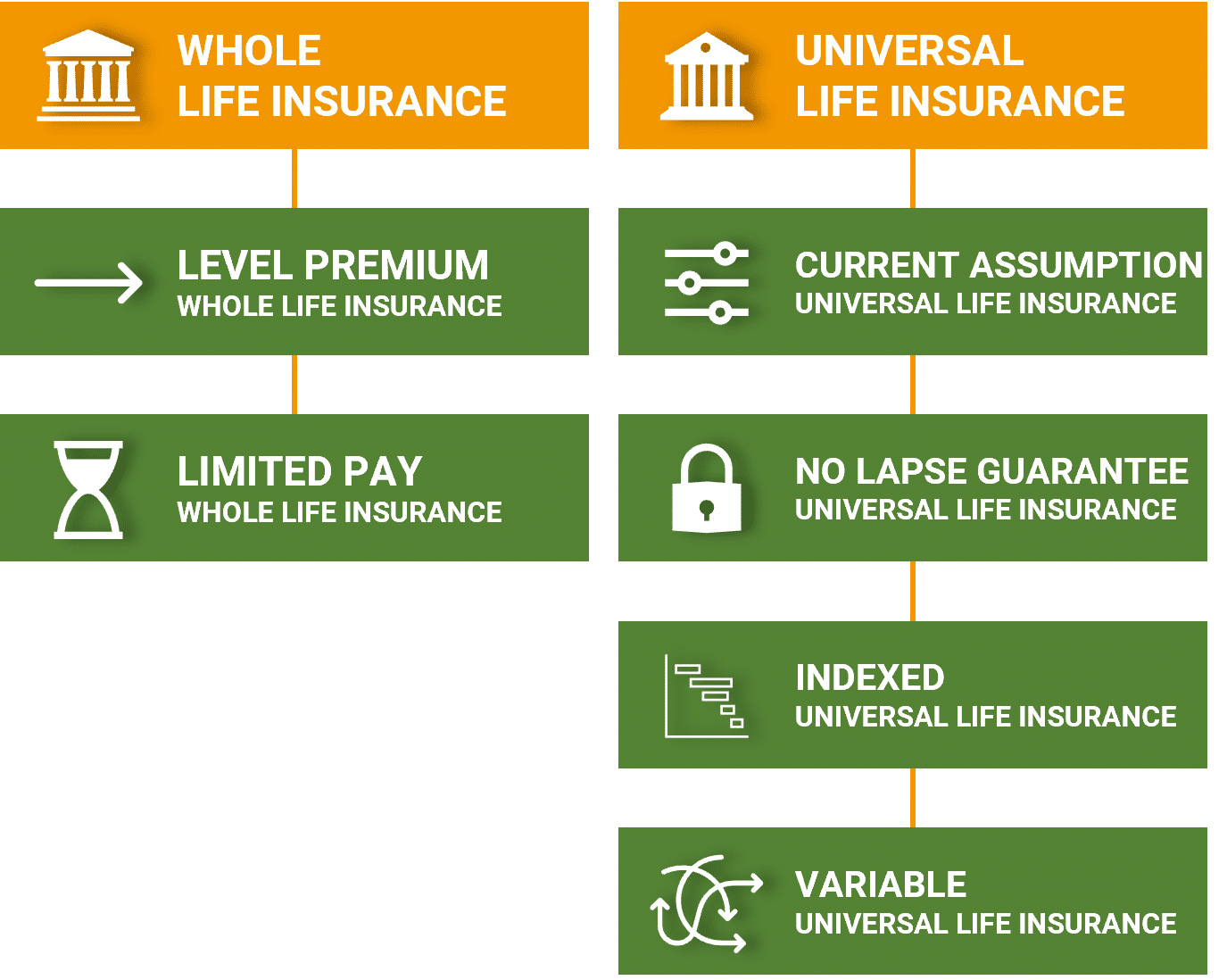

- Life Insurance: Provides financial support to beneficiaries upon your passing.

By understanding these options, you can make informed decisions that enhance your overall security and well-being, ensuring you experience a greater peace of mind in your daily life.

5 Common Misconceptions About Insurance Policies Debunked

Insurance policies can often be misunderstood, leading to misconceptions that may cause individuals to make uninformed decisions. One common myth is that all insurance policies are the same. In reality, policies vary greatly depending on the type of coverage, the provider, and regional regulations. It's important to thoroughly research and understand the specific terms and conditions of each policy rather than assuming a one-size-fits-all approach.

Another prevalent misconception is that you don't need insurance if you're healthy. While good health can reduce certain risks, unexpected accidents or illnesses can happen to anyone. For this reason, having the right insurance coverage not only protects your health but also your finances, ensuring that you're prepared for unforeseen circumstances. Always consult with a professional to ensure you're adequately covered, regardless of your current health status.

What Insurance Policy Should You Choose for Maximum Security?

Choosing the right insurance policy is crucial for ensuring maximum security for your assets, whether it's your home, vehicle, or health. Start by assessing your specific needs and risks. For instance, if you live in an area prone to natural disasters, you might want to consider comprehensive home insurance that includes coverage for floods and earthquakes. Likewise, if you rely heavily on your vehicle for daily commutes, investing in full coverage auto insurance can provide peace of mind. To make the most informed decision, create a list of essential coverages you require based on your circumstances.

Once you’ve evaluated your requirements, it’s imperative to compare different insurance providers. Look into their financial stability, customer service reviews, and claims processing efficiency. A policy that offers a lower premium might seem attractive, but if it lacks essential coverages or has a poor claims experience, it could leave you vulnerable. Utilize comparison tools and consult with insurance agents to ensure you understand the fine print. Remember, the goal is to find a policy that not only fits your budget but also provides comprehensive protection, so you can achieve complete peace of mind.