Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance Quotes: Your Wallet's Best Friend

Discover how insurance quotes can save you money and protect your finances—your wallet will thank you! Get the best deals today!

Understanding Different Types of Insurance Quotes: What You Need to Know

When shopping for insurance, understanding the different types of insurance quotes is crucial. Insurance quotes can vary significantly based on the type of coverage you need, such as auto, home, or health insurance. Generally, there are two main types of quotes: bindable quotes and estimate quotes. Bindable quotes provide a firm price from the insurer that locks in your premium and coverage options, while estimate quotes give you a ballpark figure, which may change once the insurer gathers more details about your personal situation. It’s essential to compare these quotes to ensure you're getting the best deal for your coverage needs.

Another important aspect to consider is the method through which you receive insurance quotes. You can obtain quotes directly from insurers, through independent agents, or online comparison tools. Each method has its own advantages, such as direct access to the insurer for customized coverage options or the convenience of comparing multiple offers quickly. Regardless of the method, be sure to gather relevant information about your personal circumstances, such as your driving record or property details, as this will help insurers provide more accurate quotes. By understanding these differences and knowing what information you need, you’ll be better positioned to make an informed insurance decision.

How to Save Money with the Right Insurance Quotes: Tips and Tricks

Finding the right insurance quotes is crucial for saving money while ensuring you have adequate coverage. Start by comparing multiple quotes from different providers to understand the price range. Use online comparison tools or consult with insurance brokers to make this process easier. Additionally, consider bundling your insurance policies, such as home and auto, to receive discounts. Implementing safety measures like a home security system or maintaining a good driving record can also lead to lowered premiums.

Another effective strategy is to regularly review your policies to adjust coverage where necessary. You may find that some aspects of your coverage are no longer relevant, allowing you to reduce your premium costs. Additionally, don’t hesitate to ask your provider about any available discounts—many companies offer savings for good students, military personnel, or even for members of certain organizations. Always remember that saving on insurance is not just about the cost but also about the value and protection it provides for your assets.

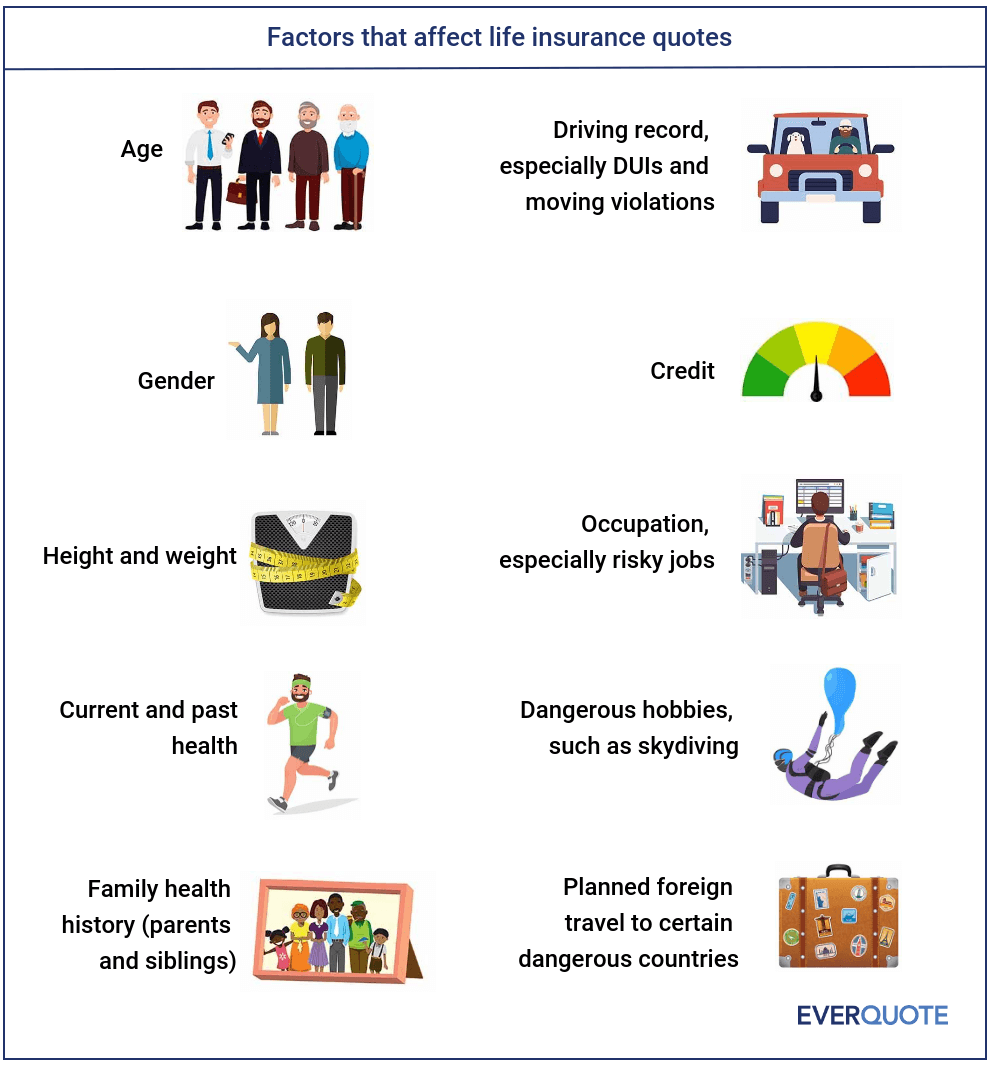

What Factors Affect Your Insurance Quotes? Unveiling the Secrets

Understanding what factors affect your insurance quotes can empower you to make more informed decisions about your coverage. One of the primary elements is your personal information, which includes your age, gender, and marital status. For example, younger drivers typically face higher premiums due to their inexperience on the road. Additionally, your credit score plays a significant role; insurers often view individuals with higher scores as lower risks. Another crucial factor is the type of coverage you choose, as comprehensive policies usually result in higher quotes compared to basic liability coverage.

In addition to personal information, various other components influence your insurance quotes. The make and model of your vehicle, for instance, can dramatically impact your premium, with luxury cars or those with high theft rates costing more to insure. Location is another critical factor; living in an area with high crime rates or frequent natural disasters often leads to increased insurance costs. Lastly, your claims history is a key element—having multiple claims can flag you as a higher-risk policyholder, resulting in steeper premiums. By understanding these factors, you can take proactive steps to potentially lower your insurance costs.