Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Pet Insurance Panic: Are You Prepared for a Furry Emergency?

Is your furry friend covered? Discover essential tips to handle pet emergencies and avoid insurance panic! Dive in now!

Top 5 Reasons Why Pet Insurance is a Must-Have for Pet Owners

As a pet owner, ensuring the health and well-being of your furry friend is a top priority. One of the most effective ways to safeguard against unexpected veterinary costs is by investing in pet insurance. Here are the top 5 reasons why pet insurance is a must-have for pet owners:

- Financial Protection: Pet insurance helps cover hefty veterinary bills in case of emergencies, which can relieve the financial burden on pet owners.

- Access to Quality Care: With pet insurance, you have the freedom to choose the best veterinarian without worrying about costs, ensuring your pet receives top-notch medical attention.

- Comprehensive Coverage: Most policies cover a wide range of services, including routine check-ups, vaccinations, and even emergency surgeries, safeguarding your pet's health throughout their life.

- Peace of Mind: Knowing that you have a financial safety net allows you to focus on your pet’s well-being without the stress of potential expenses.

- Investment in Their Future: Pet insurance is not just a plan for now; it’s an investment that protects your beloved companion as they age, ensuring they receive the necessary medical care for a happy and healthy life.

Understanding Pet Insurance: What You Need to Know Before an Emergency

Understanding pet insurance is crucial for any pet owner, especially when it comes to preparing for an emergency. Many people assume that their regular vet visits or routine check-ups are sufficient for ensuring their pet's health. However, accidents and sudden health issues can arise unexpectedly, leading to high veterinary bills. With pet insurance, you can help alleviate the financial burden and focus on getting your furry friend the treatment they need. It's important to research various policies and understand what is covered, including emergency surgeries, hospitalizations, and urgent care visits.

Before choosing a pet insurance plan, consider the following factors:

- Coverage Options: Review what types of treatments, illnesses, and conditions are covered.

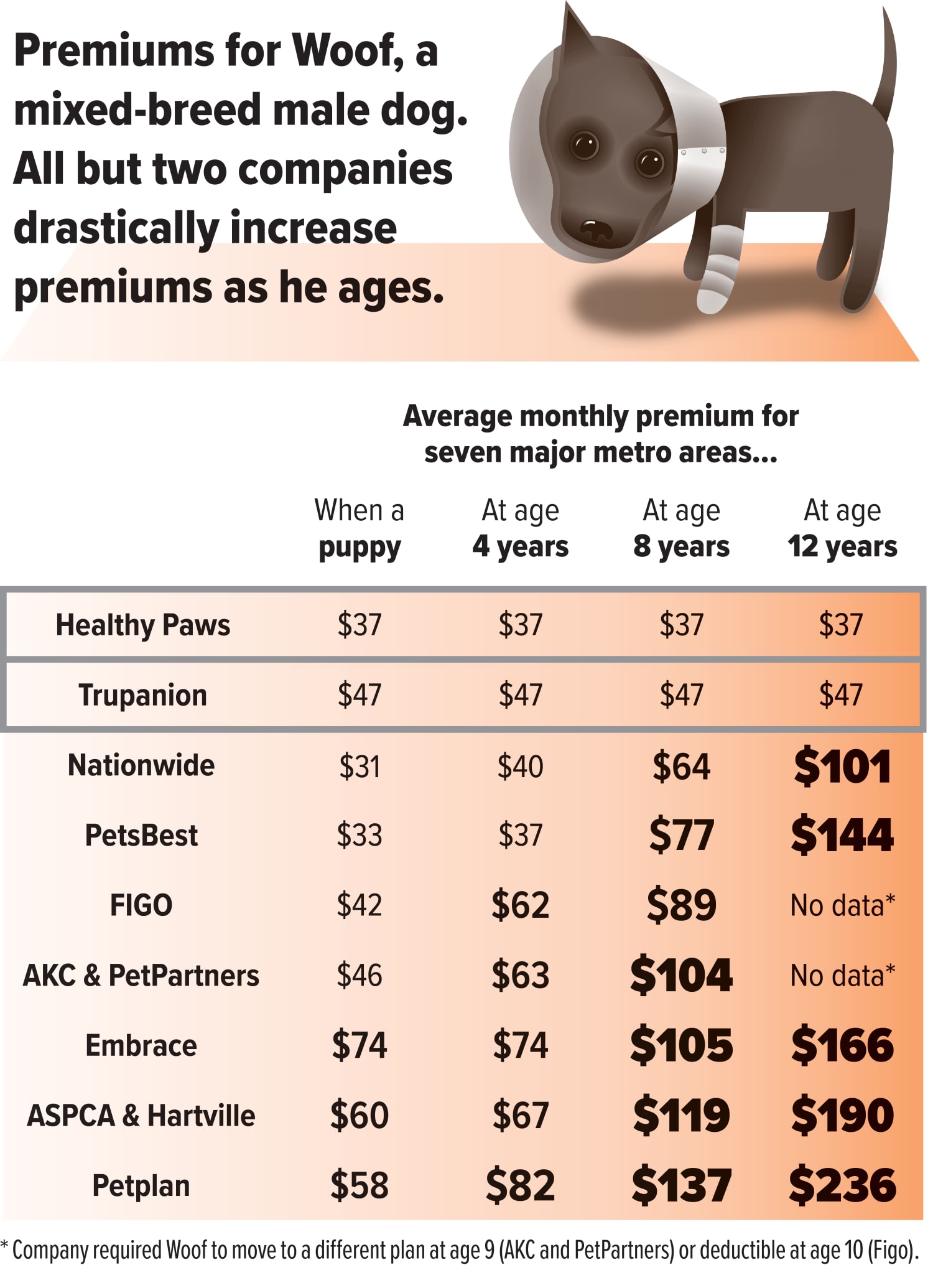

- Premiums and Deductibles: Understand the costs associated with the plan, including monthly premiums and out-of-pocket expenses.

- Exclusions: Make sure you are aware of any exclusions in the policy that may affect your pet's coverage.

Is Your Pet Covered? Common Questions About Pet Insurance Answered

Understanding pet insurance can be confusing for many pet owners. One common question is, what does pet insurance cover? In general, most policies help cover unexpected vet bills due to accidents, illnesses, and some hereditary conditions. However, it's important to note that not all plans are created equal. Some might offer additional services, like coverage for routine care or dental procedures, while others may exclude pre-existing conditions altogether. Therefore, evaluating the specific details of each policy is essential to ensure your furry friend receives the best care possible.

Another frequently asked question is, how much does pet insurance cost? The price of pet insurance varies widely based on factors such as your pet's age, breed, and location. On average, pet owners can expect to pay anywhere from $20 to $100 per month. Be sure to compare quotes from multiple providers and consider the deductibles, reimbursement percentages, and coverage limits before making a decision. By taking the time to understand the options available, you can find a plan that fits your budget while providing your pet with the protection they deserve.