Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Quote Me If You Can: The Fun of Comparing Insurance Prices

Unlock savings and discover the thrill of comparing insurance prices! Find out how to secure the best deals effortlessly!

Understanding the Benefits of Comparing Insurance Prices

Comparing insurance prices is a crucial step for anyone looking to save money and find the best coverage for their needs. By taking the time to compare insurance prices, consumers gain insights into the variety of policies available, which may vary significantly in terms of premiums and coverage options. A thorough comparison allows individuals to identify gaps in their current coverage and potentially spot better deals elsewhere, ensuring the best value for their investment. In fact, even small differences in premiums can add up to substantial savings over time.

Moreover, comparing insurance prices not only helps in identifying more affordable options but also promotes informed decision-making. It encourages consumers to analyze policy details and assess their personal requirements, such as deductibles, limits, and exclusions. This practice can lead to enhanced satisfaction with the chosen policy and provide peace of mind, knowing that the coverage is tailored to individual needs. In essence, the benefits of actively comparing insurance prices extend beyond just financial savings; they foster a deeper understanding of the various options in the insurance marketplace.

How to Effectively Compare Insurance Quotes: A Step-by-Step Guide

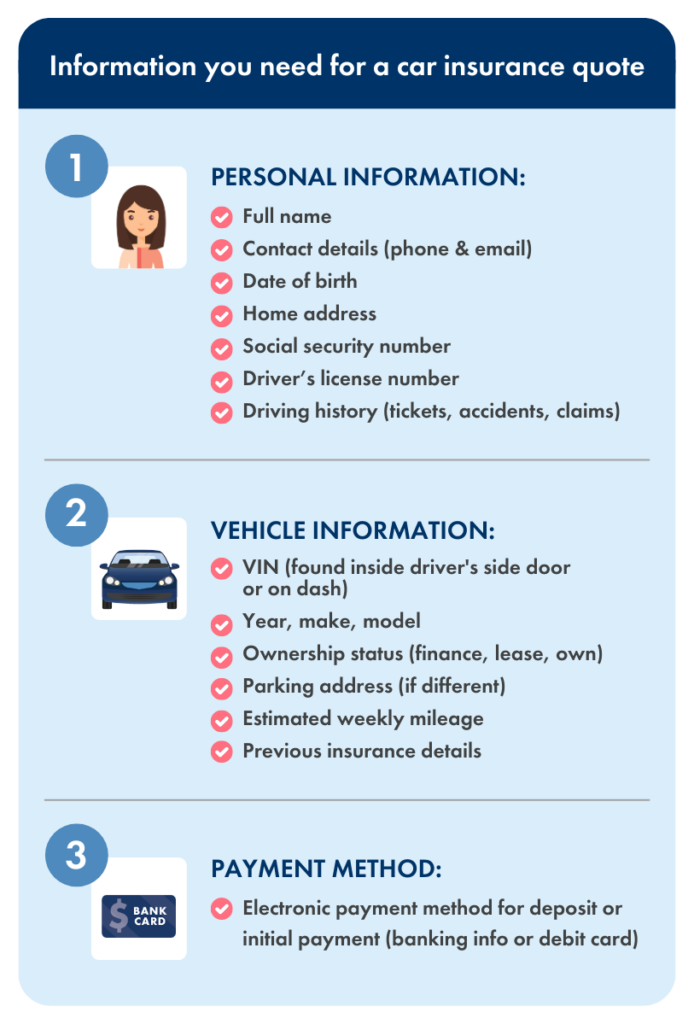

When you're looking to effectively compare insurance quotes, the first step is to gather multiple insurance quotes from different providers. Start by identifying the type of insurance you need—be it auto, home, health, or life insurance. Once you have that determined, request quotes online from various insurance companies. Most insurers will allow you to compare coverage and premiums side by side, making it easier to see where you stand. Ensure you provide the same information to each insurer to get accurate comparisons.

Next, analyze the details of each quote, considering not just the premium costs but also the coverage limits, deductibles, and exclusions. Create a simple table or list to track these variables:

- Premium Costs: The monthly or yearly fee.

- Coverage Limits: The maximum amount the insurer will pay.

- Deductibles: The amount you pay out of pocket before coverage kicks in.

- Exclusions: Situations or conditions not covered by the policy.

This method will help you visualize and compare the key aspects, ultimately allowing you to make a more informed decision about which insurance provider suits your needs best.

Why You Should Never Settle for the First Insurance Quote

When it comes to securing insurance for your needs, settling for the first insurance quote you receive can be a costly mistake. Insurance policies vary greatly in terms of coverage, premium rates, and terms. By taking the time to compare multiple quotes, you can ensure that you are not only getting the best price but also the most comprehensive coverage for your situation. Remember, not all policies are created equal; what may seem like a great deal at first could leave you with significant gaps in coverage.

Additionally, obtaining several quotes allows you to identify any discrepancies in coverage options and understand the market better. Learning about various insurance providers can give you insights into their customer service reputation, claims handling process, and overall reliability. In short, by avoiding the temptation to settle for the first insurance quote, you empower yourself to make an informed decision that could save you money and provide peace of mind in the long run.