Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Quote Me If You Can: Navigating the World of Insurance Comparisons

Discover insider tips to master insurance comparisons and find the best deals effortlessly. Your savings start here!

Understanding Insurance Comparison: Key Factors to Consider

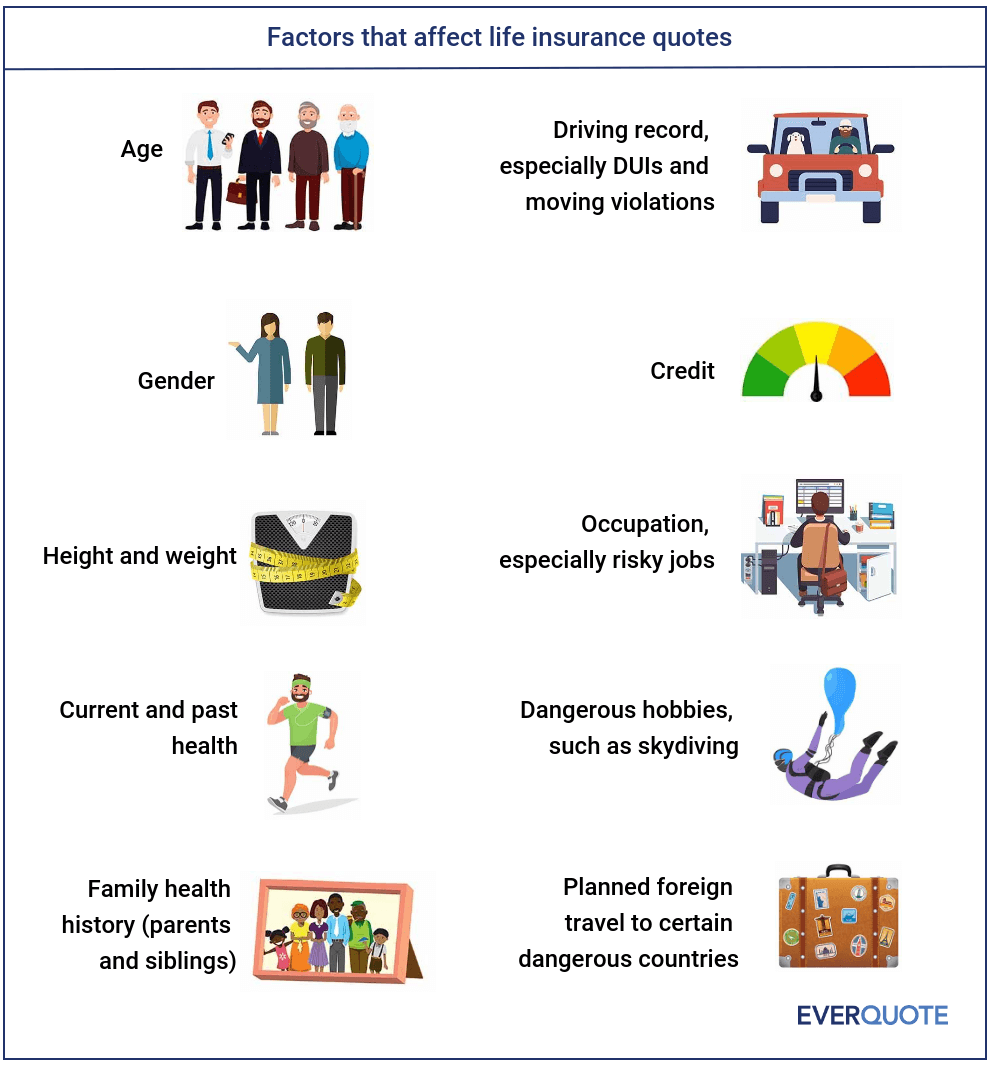

When it comes to insurance comparison, there are several key factors that consumers should take into account to ensure that they make well-informed decisions. First and foremost, assess the coverage options provided by different insurers. This includes understanding the types of coverage available, such as liability, comprehensive, or collision coverage, and determining which ones best meet your specific needs. Additionally, evaluating the deductibles and limits of each policy can significantly influence your overall premium costs and coverage efficiency.

Another crucial aspect of insurance comparison is the premium pricing. It is advisable to gather multiple quotes from various providers and analyze them side by side. Look out for hidden fees, discounts for bundled policies, and any other factors that could affect the final cost. Also, consider the insurer’s financial stability and customer service track record; reading reviews or checking ratings can provide valuable insights. By taking into account these factors, you can make a more informed choice, ultimately securing the best policy tailored to your unique requirements.

Top 5 Mistakes to Avoid When Comparing Insurance Policies

When comparing insurance policies, avoiding common pitfalls can make all the difference in finding the right coverage for your needs. One of the most significant mistakes is not thoroughly understanding the terms and conditions of each policy. Insurers often use complex language and jargon that can lead to misunderstandings. Always take the time to read the fine print and, if necessary, consult with an expert to clarify any confusing terms. This diligence can help you avoid unexpected costs and ensure that you choose a policy that truly meets your needs.

Another critical error is failing to consider your unique situation. Each individual or family has different needs and circumstances that should influence policy selection. For example, what works for a young family might not be suitable for a retiree. It’s essential to make a list of your specific needs, including coverage types, deductibles, and budget constraints, before beginning your comparison. By doing so, you can make a more informed decision and select a policy that complements your lifestyle.

How to Use Online Tools for Effortless Insurance Comparisons

When it comes to insurance comparisons, leveraging online tools can significantly streamline the process. These platforms allow you to input your personal information and receive tailored quotes from various providers in a matter of minutes. Start by visiting reputable insurance comparison websites, where you can fill out a simple questionnaire. This may include details like your age, location, type of coverage needed, and any specific requirements you may have. Once submitted, the tool will generate a list of quotes from multiple insurers, giving you a comprehensive view of your options.

Moreover, using online tools for insurance comparisons not only saves time but also enhances your ability to make informed decisions. Many of these websites feature user reviews, ratings, and even expert analyses to help you understand the strengths and weaknesses of different policies. It’s essential to take the time to compare not just the premiums, but also the coverage limits and exclusions. Consider creating a comparison chart to visualize your findings and ensure you select the best policy that fits your needs and budget.