Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Quote Quest: Finding the Best Insurance Deals Without the Headache

Unlock stress-free savings! Discover top insurance deals swiftly with Quote Quest and say goodbye to headaches. Your best rates await!

Top 5 Tips for Comparing Insurance Quotes Effectively

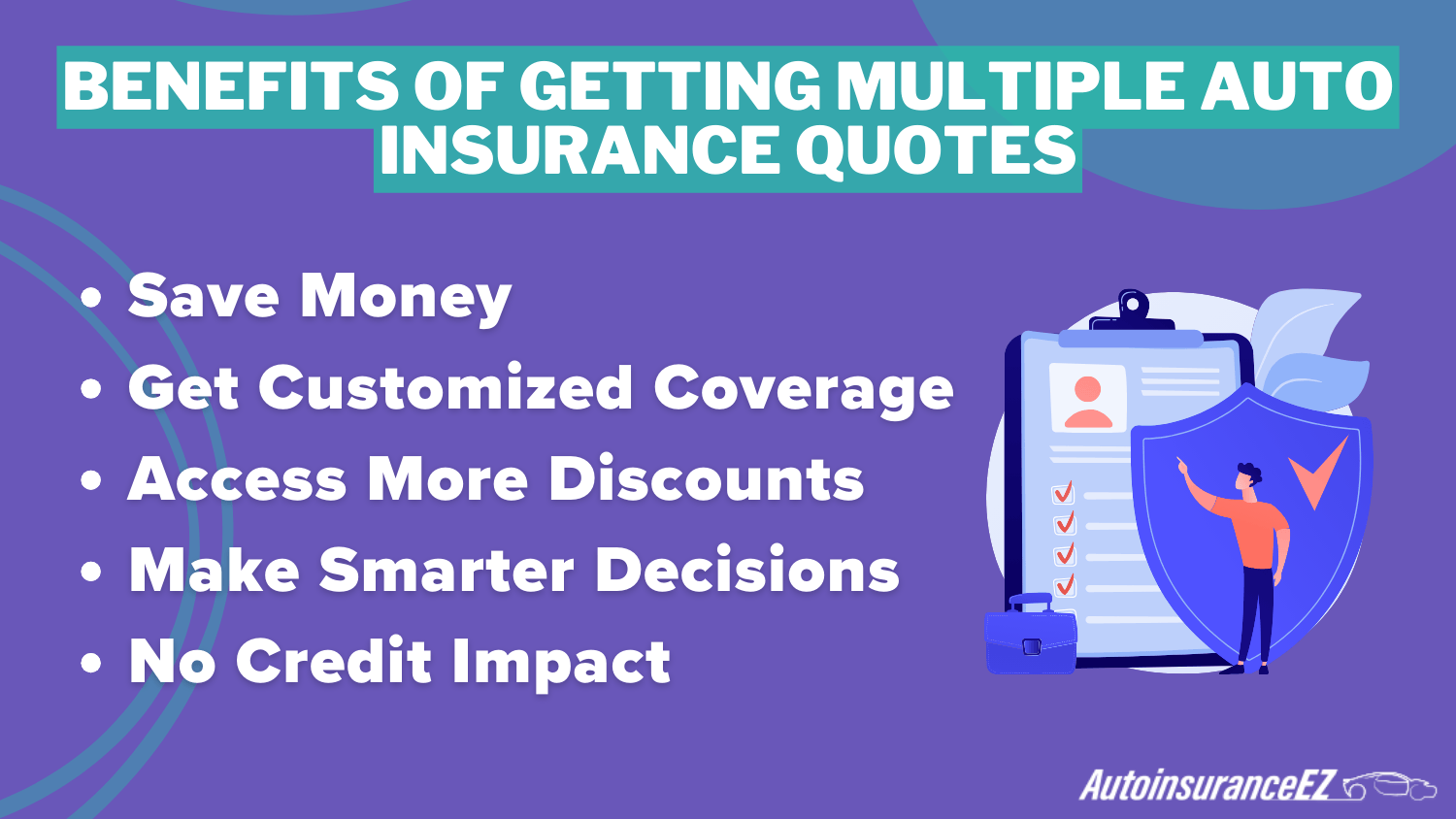

Comparing insurance quotes can be a daunting task, but with the right approach, it can be simplified. Start by gathering multiple quotes from different providers. Aim to collect at least three to five quotes to ensure a wide range of options. This will give you a better perspective on the average pricing and coverage available. When comparing quotes, make sure that you are comparing similar coverage levels, as a lower price may come with reduced benefits. Keep track of each quote in a well-organized spreadsheet to easily compare the details side by side.

Another useful tip is to consider the deductibles and coverage limits associated with each policy. A policy may have a lower premium but a higher deductible that could impact your overall expenses in the event of a claim. Additionally, look for any discounts that may apply, such as bundling multiple policies or safe driving records. Lastly, don't forget to read customer reviews and check the financial stability of the insurance companies you're considering. This way, you'll ensure you're not only getting a competitive price but also choosing a company that provides reliable service when you need it the most.

The Ultimate Guide to Navigating Insurance Deals with Ease

Navigating insurance deals can often feel overwhelming, but with the right approach, you can simplify the process significantly. Start by understanding your needs: Determine what type of insurance you require, whether it’s health, auto, home, or life. Assess your current coverage and identify gaps that need to be filled. Research multiple providers and their offerings to ensure you are aware of all available options. Comparing policies not only helps in finding the best price but also ensures that you are receiving comprehensive coverage that meets your specific requirements.

To make the most informed decisions, use technology to your advantage. Many websites offer comparison tools that allow you to input your information and receive tailored quotes from various insurers. Additionally, consider reading customer reviews and ratings to gauge the reliability and service quality of potential insurers. Remember, an affordable premium shouldn’t come at the cost of poor support during crises. Follow these steps, and you’ll be well on your way to navigating insurance deals with ease

What to Look for When Seeking the Best Insurance Quotes?

When seeking the best insurance quotes, it’s essential to start with a clear understanding of your needs. Begin by assessing what coverage types are necessary for your situation, whether it be auto, health, home, or life insurance. Once you identify your requirements, gather multiple quotes to compare pricing and coverage options. Utilize online quote comparison tools which allow you to view different providers side by side, ensuring you don’t overlook any crucial details. Remember to check for any hidden fees or exclusions that may affect your final decision.

Another vital factor to consider is the reputation and financial stability of the insurance providers. Make sure to read customer reviews and ratings to gauge the quality of their service. Additionally, consult financial standings through reputable ranking agencies to ensure they can handle claims efficiently. It’s also wise to inquire about any discounts that may apply, such as safe driver discounts, multi-policy discounts, or loyalty rewards. By meticulously evaluating these aspects, you’ll be better equipped to find the best insurance quotes tailored to your personal needs.