Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Why Renters Insurance is the Secret Weapon for Your Peace of Mind

Unlock ultimate peace of mind! Discover why renters insurance is your secret weapon against unexpected mishaps and financial headaches.

Top 5 Reasons Renters Insurance is Essential for Every Tenant

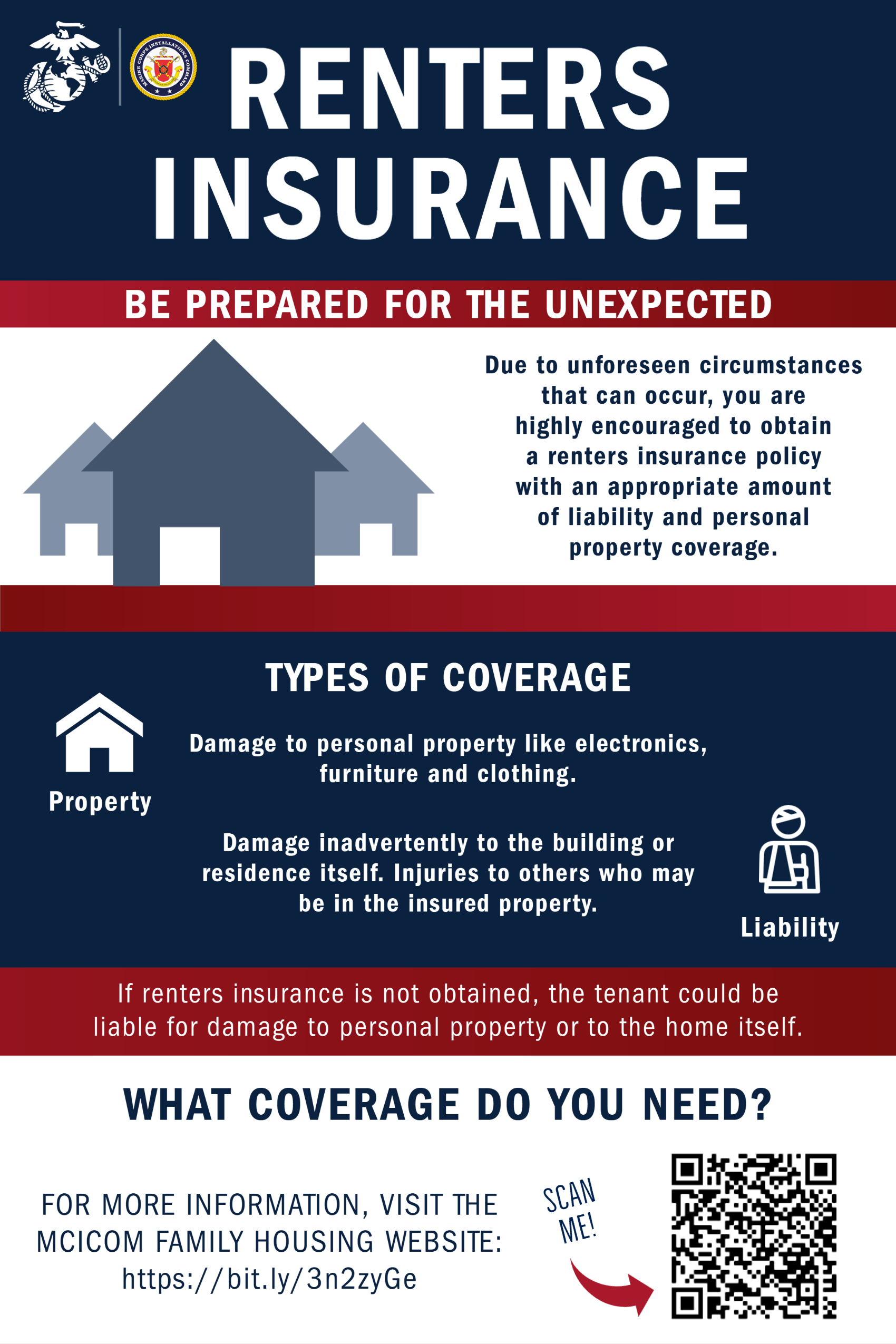

Renters insurance is often overlooked by tenants, yet it plays a vital role in protecting personal belongings. One of the top reasons to consider renters insurance is that it covers the loss of personal property due to theft, fire, or other unforeseen events. This means that whether your electronics are stolen or your furniture is damaged, you won't bear the full financial burden. In fact, many policies also include liability coverage, which can help protect you if someone gets injured in your rented home.

Another crucial reason for obtaining renters insurance is the peace of mind it provides. Knowing that your valuables are insured allows you to focus on enjoying your living space without the constant worry of potential loss. Additionally, many landlords require tenants to carry renters insurance as part of their lease agreement, making it not just a smart choice, but often a necessary one. In short, protecting yourself with renters insurance safeguards your belongings and ensures you comply with rental agreements.

What Does Renters Insurance Actually Cover? A Breakdown for Peace of Mind

Renters insurance is designed to protect tenants from unexpected events that can lead to substantial financial loss. It typically covers personal property damage due to perils such as fire, theft, vandalism, and certain natural disasters. For instance, if a fire damages your belongings or a thief steals your electronics, renters insurance can help you recover the value of those items. Additionally, most policies include liability coverage, which protects you if someone is injured in your rental unit and decides to sue for damages.

It's also important to note that renters insurance may offer additional living expenses (ALE) coverage. This means if your rental unit becomes uninhabitable due to a covered incident, your insurance provider can help cover the costs of temporary housing and basic living expenses during the repair process. To ensure you have the right protection, review your policy thoroughly and make sure you understand any exclusions or limits. Having renters insurance gives you peace of mind, knowing that your personal property and financial stability are secure in the event of the unexpected.

Is Renters Insurance Worth the Cost? Debunking Common Myths

When considering whether renter's insurance is worth the cost, many tenants are quick to dismiss it, often falling prey to common myths. One prevalent misconception is that your landlord's insurance covers your personal belongings. In reality, this is not the case; landlord insurance only protects the physical structure of the building, leaving tenants vulnerable. Without renter's insurance, if a fire, theft, or natural disaster occurs, individuals may find themselves facing significant financial losses. It's essential to understand that for a modest monthly premium, you can safeguard your personal property against unexpected events.

Another myth suggests that renter's insurance is unnecessarily expensive. In fact, the average cost of a policy is surprisingly affordable, often ranging between $15 to $30 per month, depending on various factors such as location and coverage amount. Moreover, many policies offer additional benefits, such as liability coverage and temporary living expenses in case your rental becomes uninhabitable. Ultimately, debunking these myths reveals that renter's insurance is not only worth the cost but also a smart financial decision for anyone renting a home.