Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Saving Pennies, Insuring Dollars: Your Wallet Will Thank You

Unlock savvy savings tips to boost your budget! Discover how small changes can lead to big financial wins for your wallet.

Top 5 Budgeting Tips to Save More Pennies

When it comes to personal finance, mastering the art of budgeting is essential for saving more pennies. Here are five essential budgeting tips that can help you take control of your financial situation:

- Track Your Expenses: Begin by recording all of your expenses for a month. This will provide you with a clear overview of where your money goes and highlight areas where you can cut back.

- Set a Realistic Budget: Create a monthly budget based on your income and necessary expenses. Ensure your budget is realistic and allows for some flexibility to accommodate unexpected expenses.

- Prioritize Saving: Treat your savings like a fixed expense. Set aside a portion of your income each month for savings and investments before allocating money for discretionary expenses.

Additionally, consider these final two tips to maximize your savings:

- Use Cash Envelopes: For discretionary spending categories like entertainment or dining out, use cash to limit overspending. Once the cash is gone, resist the temptation to dip into other funds.

- Review Your Expenses: Regularly revisit your budget to identify areas for improvement. Whether it's eliminating unused subscriptions or finding better deals, constantly reassessing your expenses can lead to significant savings.

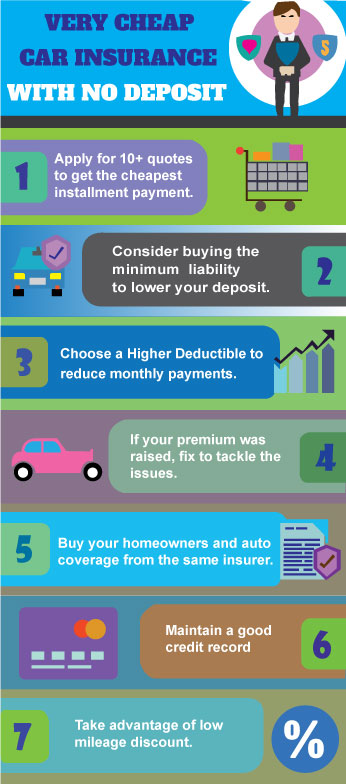

How Proper Insurance Can Protect Your Hard-Earned Dollars

In today's uncertain world, proper insurance serves as a vital shield for your financial investments. By securing the right coverage, you can effectively protect your hard-earned dollars from unforeseen events that could derail your financial stability. Whether it's homeowner's insurance that safeguards your property against natural disasters or health insurance that covers unexpected medical expenses, having the appropriate policies in place minimizes risks associated with life's unpredictability.

Moreover, understanding the types of insurance available can help you make informed decisions that specifically cater to your needs. Consider the following categories of insurance that can help you conserve your wealth:

- Auto Insurance: Protects against vehicle damage and liabilities.

- Life Insurance: Ensures your loved ones are financially secure after your passing.

- Disability Insurance: Offers income replacement if you cannot work due to illness or injury.

- Umbrella Insurance: Provides an extra layer of liability protection.

Investing in the right insurance not only provides peace of mind but also secures your financial future against unexpected hardships.

Are You Throwing Away Money? Common Financial Mistakes to Avoid

In today's fast-paced world, managing finances effectively is crucial to ensure you're not throwing away money on unnecessary expenses. Many people fall into the trap of impulse buying, which can lead to significant long-term financial pitfalls. Avoid this by making a conscious effort to differentiate between needs and wants. Create a budget and stick to it; this will help you keep track of your spending habits and identify areas where you are overspending. Additionally, consider setting financial goals to stay motivated and understand the importance of saving for future needs.

Moreover, neglecting to plan for emergencies can be a costly mistake. Establishing an emergency fund can save you from financial strife when unexpected expenses arise, such as medical bills or car repairs. It's also essential to review your subscriptions and recurring payments regularly; you might be surprised at how many services you’re paying for but no longer use. Keeping an eye on your monthly expenditures not only prevents waste but can also improve your overall financial health in the long run.