Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

The Surprising Truth Behind Insurance Quotes

Uncover the hidden secrets of insurance quotes that could save you money. Discover the truth behind the numbers and boost your savings today!

What Factors Really Influence Your Insurance Quotes?

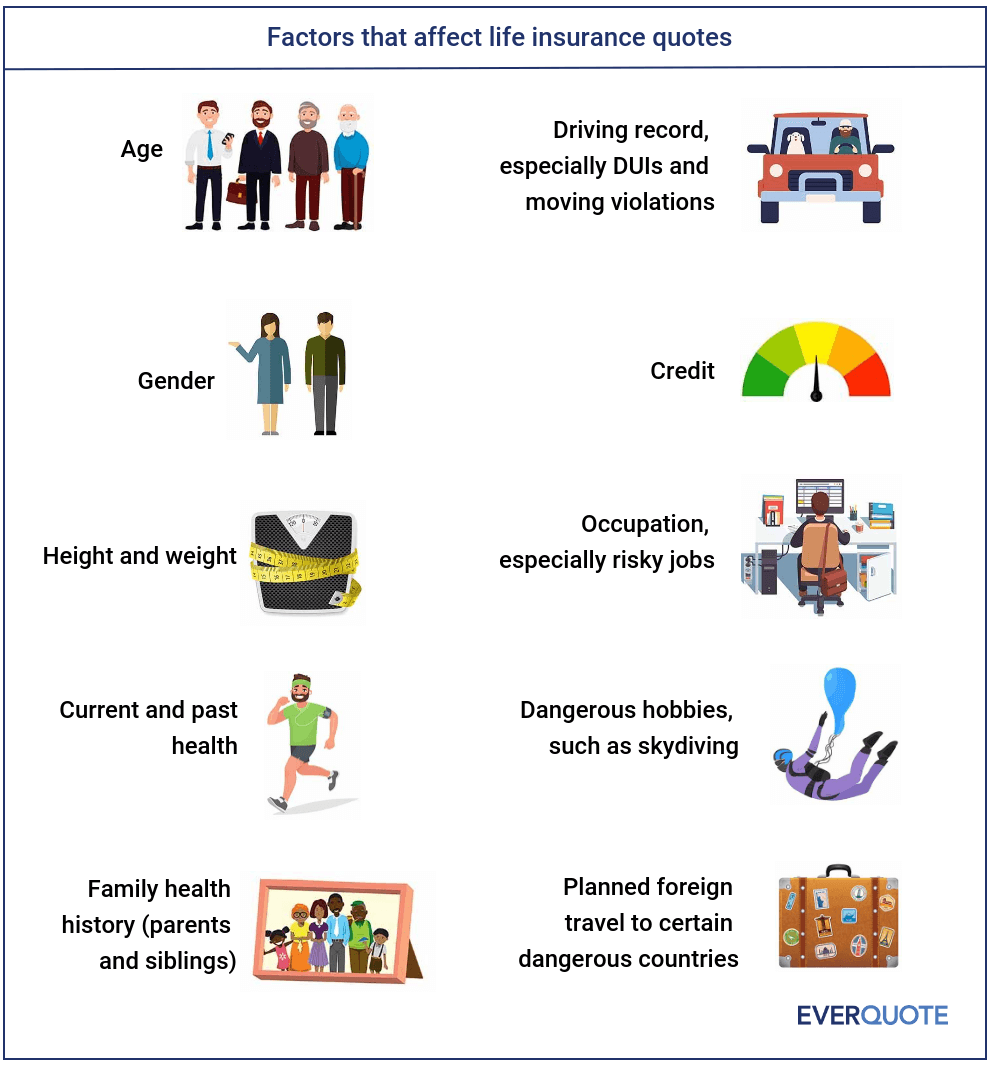

When it comes to understanding what factors really influence your insurance quotes, several key elements come into play. First, your personal information such as age, gender, and marital status can significantly affect the rates you are offered. For example, younger drivers typically encounter higher premiums due to their inexperience. Additionally, factors like credit score and the type of coverage selected can further sway the quote. Insurance companies often use data analytics to assess risk, making these parameters crucial in determining the final premium.

Moreover, the location where you live plays a substantial role in your insurance quotes. Areas with higher crime rates or a history of natural disasters tend to incur higher premiums. The make and model of your vehicle, if you are looking for auto insurance, is another significant factor; cars that are more prone to accidents or theft typically result in elevated rates. Lastly, your driving history, including prior claims and violations, will dramatically shape the quote you receive, as insurers see a correlation between past behaviors and future risks.

The Hidden Costs of Insurance Quotes: What You Need to Know

When seeking insurance quotes, many consumers focus solely on the premium costs, often overlooking the hidden costs associated with these quotes. One significant aspect to consider is the deductibles and co-payments that can vary widely between policies. These costs can drastically affect your out-of-pocket expenses in the event of a claim, making it crucial to evaluate them alongside the premium. Additionally, it's essential to be aware of any exclusions or limitations that may apply to the coverage, which can lead to unexpected expenses during a claim process.

Another factor contributing to the hidden costs of insurance quotes is the varying levels of coverage provided. Consumers often select a lower premium without fully understanding what they are sacrificing in terms of benefits. For instance, a policy with minimal coverage may leave you financially exposed in specific scenarios, requiring you to pay more out-of-pocket. Furthermore, fees such as policy administration charges or cancellation fees can add to the overall costs that aren't immediately apparent during the quote comparison. To make an informed decision, it’s vital to read the fine print and assess the overall value of what you're being offered.

Are You Paying Too Much? How to Decode Your Insurance Quote

When receiving an insurance quote, it is crucial to understand how various factors influence the cost. Many people fall into the trap of assuming that a higher premium automatically means better coverage. This isn't always the case. Are you paying too much? Start by comparing quotes from different providers and looking for significant discrepancies. Factors such as your age, driving history, location, and even your credit score can impact your quote. It's advisable to create a checklist of key elements to review, such as:

- Coverage limits

- Deductibles

- Discounts available

Another important aspect to consider is the type of coverage you actually need. Many insurance policies contain optional add-ons that can lead to inflated costs without adequate benefits. To decode your insurance quote, first clarify the coverage requirements based on your personal situation. Are you paying too much? Consider discussing your policy with an expert who can help you identify unnecessary coverages and guide you toward a more tailored policy that meets your needs without breaking the bank. Always remember that understanding all components of your quote is essential in ensuring you're not paying more than what is actually required.