Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Whole Life Insurance: The Financial Safety Net You Didn't Know You Needed

Discover the hidden benefits of whole life insurance and why it’s the financial safety net you can't afford to ignore!

Understanding Whole Life Insurance: Benefits and Myths Explained

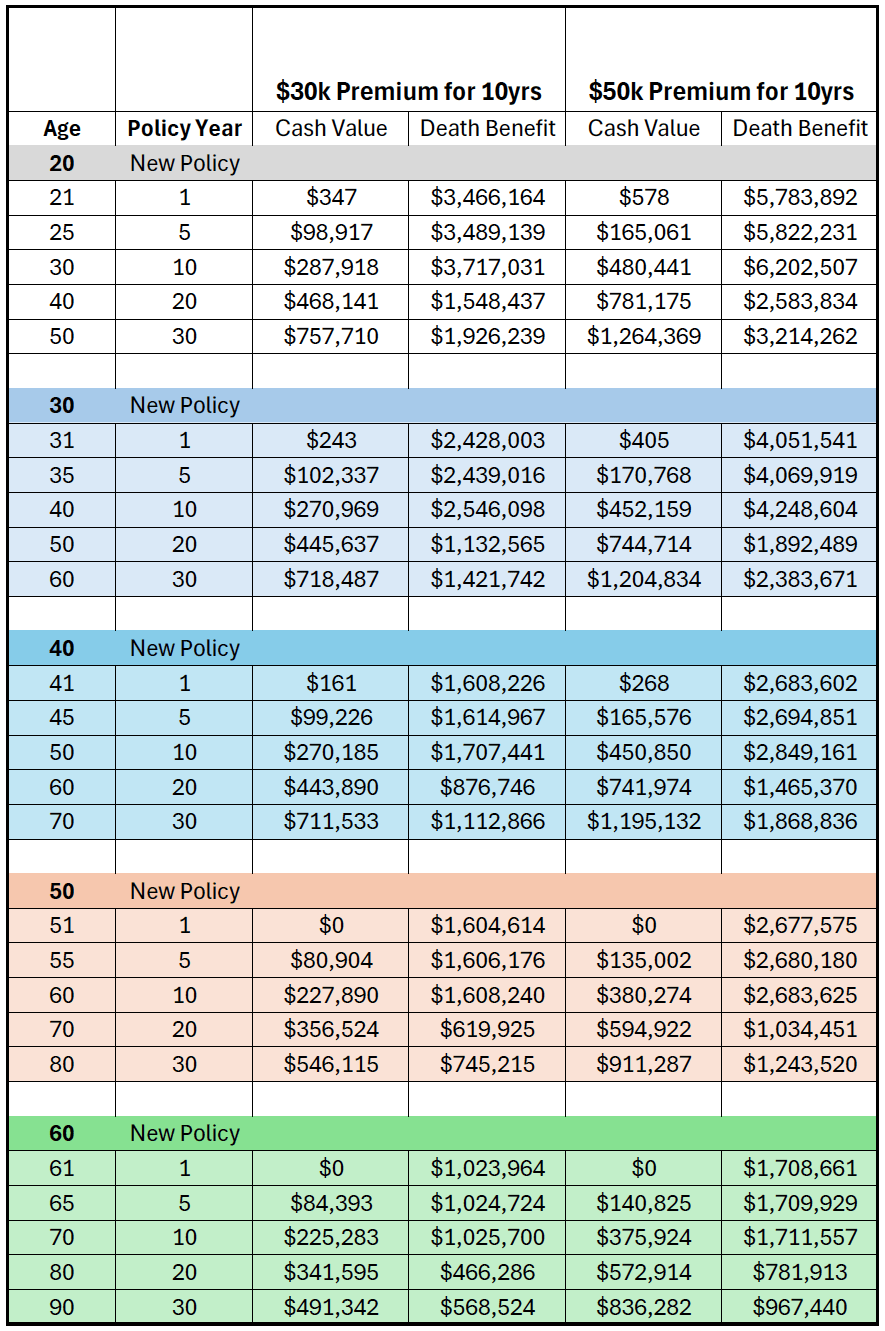

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. One of the main benefits of whole life insurance is its cash value accumulation, allowing policyholders to build savings over time that can be borrowed against or withdrawn if needed. Additionally, whole life insurance provides guaranteed death benefits, offering financial security to beneficiaries. This dual function of providing both insurance coverage and a savings component makes it an attractive option for long-term financial planning.

Despite the numerous advantages, several myths surrounding whole life insurance can lead to misunderstandings. One common misconception is that whole life insurance is too expensive. While it's true that the premiums are generally higher than those of term life insurance, the benefits and savings can outweigh the cost in the long run. Moreover, some believe that whole life insurance is not flexible, but many policies offer options to adjust coverage and premium payments. For a deeper understanding of these benefits and to clear up these myths, you can visit NerdWallet.

Is Whole Life Insurance Right for You? Key Questions to Consider

Determining whether whole life insurance is right for you involves asking a few key questions about your financial goals and personal needs. First, consider how long you need coverage—if your goal is lifelong protection, whole life insurance can provide a stable solution. Additionally, think about your ability to pay higher premiums compared to term life insurance. Whole life policies are often more expensive, but they also build cash value over time. This element can serve as a financial resource, making whole life insurance an appealing option for those looking to merge insurance with a savings component.

Another crucial factor to consider is your estate planning needs and whether leaving an inheritance is important to you. Whole life insurance offers the benefit of guaranteed payouts to beneficiaries, allowing you to provide for loved ones even after you're gone. It's also worthwhile to assess your overall investment strategy; while some may prefer the cash value growth of a whole life policy, others may find more lucrative opportunities elsewhere. Reflect on your long-term financial stability and savings preferences before making a decision, ensuring that your choice aligns with your future aspirations.

How Whole Life Insurance Acts as a Financial Safety Net for Families

Whole life insurance serves as a crucial financial safety net for families by providing a guaranteed death benefit that ensures financial stability during difficult times. In the event of an unexpected loss, the proceeds from a whole life insurance policy can help cover essential expenses such as mortgage payments, educational costs, and day-to-day living expenses. This financial support allows families to maintain their current lifestyle, alleviating the stress and burden that often accompanies the loss of a breadwinner. As a result, whole life insurance is not just a policy; it is a critical component of a comprehensive financial plan.

Moreover, whole life insurance offers an additional layer of security through its cash value component, which accumulates over time and can be accessed by the policyholder. This cash value can serve as a source of funds for major life expenses, such as college tuition or unexpected medical bills, providing families with added financial flexibility. Furthermore, unlike term life insurance, which expires after a set period, whole life insurance remains in force for the insured's lifetime, making it a reliable long-term investment. For a deeper understanding of how whole life insurance functions, consider exploring articles from Investopedia and the Nolo website.