Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Whole Life Insurance: The Lifelong Hug Your Money Needs

Discover how Whole Life Insurance offers the lifelong security and financial peace of mind your money craves—hugs for your future await!

Understanding Whole Life Insurance: Benefits and Features Explained

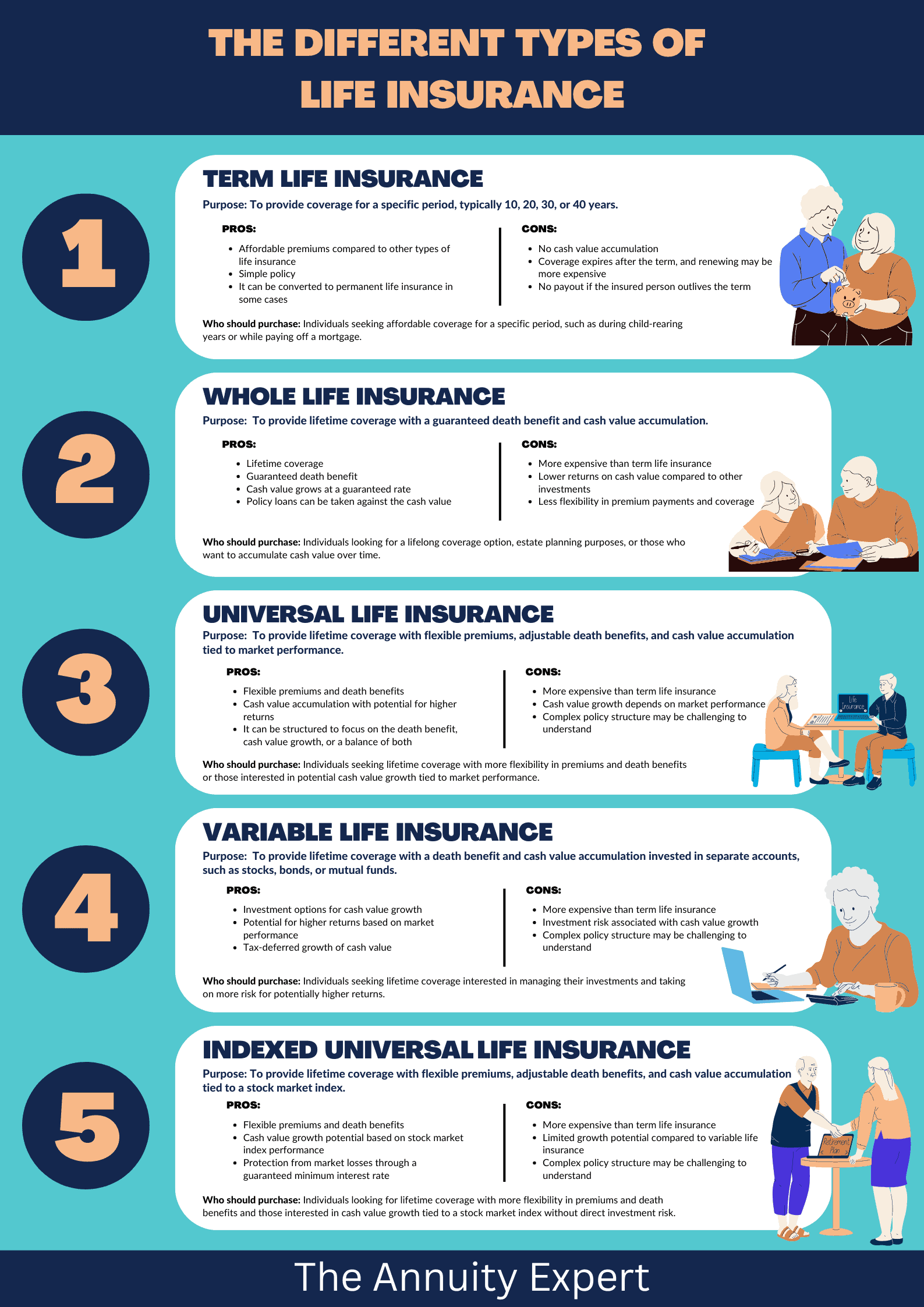

Whole life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. This dual benefit makes it an appealing choice for individuals seeking long-term financial security. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance guarantees coverage for the insured's entire life, as long as premiums are paid. One of the primary advantages of whole life insurance is its cash value accumulation, which grows at a guaranteed rate over time. This cash value can be borrowed against or withdrawn, providing financial flexibility.

Moreover, whole life insurance provides guaranteed premiums, meaning the amount you pay will not increase over time. This predictability is comforting for policyholders, allowing for better long-term financial planning. Another noteworthy feature is the potential for dividends, which some whole life policies pay to policyholders based on the insurer's financial performance. These dividends can be taken as cash, used to reduce premiums, or reinvested to increase the policy's cash value. Understanding these benefits and features can help individuals make informed decisions about incorporating whole life insurance into their overall financial strategy.

Common Myths About Whole Life Insurance Debunked

Whole life insurance is often misunderstood, leading to several common myths that can misguide potential policyholders. One prevalent misconception is that whole life insurance is only beneficial for the wealthy. While it is true that whole life policies can have higher premiums compared to term life insurance, the long-term financial benefits, such as cash value accumulation and death benefits, make it a viable option for a variety of budgets. Additionally, these policies provide lifelong coverage, ensuring that beneficiaries are protected regardless of health changes in the future.

Another myth is that whole life insurance does not offer flexibility. In reality, many whole life policies come with options to borrow against the cash value or even to convert to a different type of policy if needed. This adaptability can be crucial as personal circumstances change. Moreover, some individuals believe that once they purchase a whole life policy, they are locked in for life with no room for adjustment. However, policyholders can typically customize their coverage to better fit their evolving financial situation.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whether whole life insurance is right for you, it's essential to evaluate your long-term financial goals. Whole life insurance provides a combination of insurance coverage and a cash value component that grows over time. This can be especially beneficial if you are looking for a policy that not only protects your loved ones but also serves as a financial asset. Here are some key factors to consider:

- Your current financial situation

- Your future financial needs

- Any existing debts or responsibilities

Another crucial aspect to ponder is your risk tolerance and how whole life insurance fits into your overall financial strategy. Unlike term life insurance, which offers coverage for a specific period, whole life insurance lasts your entire lifetime, assuming premiums are paid. This stability can be appealing, but it's important to weigh the higher premiums against the benefits. Ask yourself the following questions:

- Can I afford the premiums long-term?

- How does this policy align with my investment goals?

- Aren't there other investment vehicles that might yield better returns?