Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

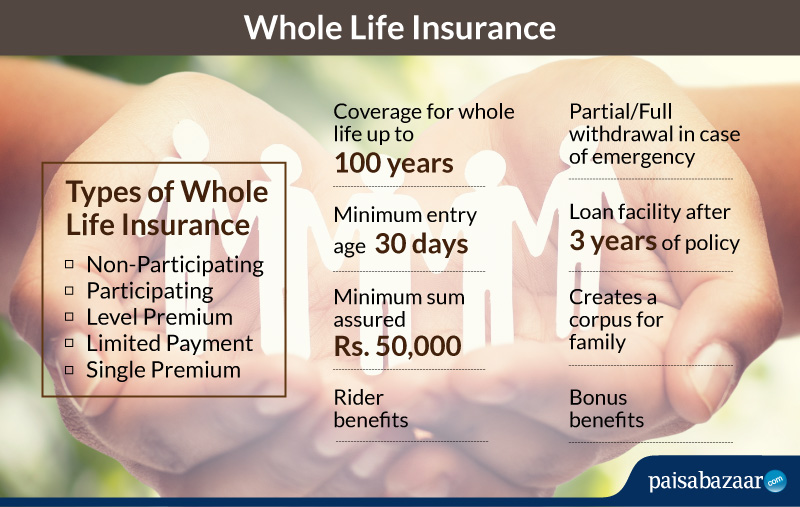

Whole Life Insurance: Your Ticket to Lifelong Peace of Mind

Unlock lifelong peace of mind with whole life insurance. Discover the benefits and secure your family's future today!

Understanding Whole Life Insurance: Key Benefits Explained

Whole life insurance is a type of permanent life insurance that offers coverage for the entirety of the policyholder's life, as long as premiums are paid. One of the primary benefits is the guarantee of a death benefit, which provides financial protection to beneficiaries. Additionally, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn. This dual feature makes it an appealing option for those looking for long-term security and a form of savings.

Another significant advantage of whole life insurance is the stability it offers in premium payments. Unlike term life insurance, where premiums can increase significantly upon renewal, whole life insurance typically has fixed premiums throughout the life of the policy. This predictability can be a crucial aspect for budgeting. Furthermore, the growth of cash value is tax-deferred, meaning you won't pay taxes on the gains as they accumulate, providing a potential source of funds for emergencies, retirement, or other financial needs.

Is Whole Life Insurance Right for You? Factors to Consider

When considering whether whole life insurance is right for you, it's essential to evaluate your financial goals and needs. Whole life insurance provides lifelong coverage and builds cash value over time, making it a potentially valuable asset. Here are some factors to consider:

- Long-term financial commitment: Whole life insurance requires consistent premium payments, which can be higher than term life insurance. Assess your budget to determine if you can make this commitment.

- Investment aspect: The cash value component can serve as a savings vehicle, so think about whether this aligns with your overall financial strategy.

Additionally, you should take into account your current health and family situation. Whole life insurance premiums are typically locked in at your purchase age, so acquiring a policy while you're younger and healthier can be more cost-effective. Consider your dependents and future financial obligations, as whole life insurance can provide a steady financial safety net. Finally, consulting with a financial advisor can help you weigh the pros and cons in light of your personal circumstances.

How Whole Life Insurance Can Secure Your Family's Financial Future

Whole life insurance is a critical component of a comprehensive financial plan that can provide lasting security for your family's future. Unlike term life insurance, which only covers a specific period, whole life insurance offers lifelong protection. This means that, as long as you consistently pay your premiums, your beneficiaries will receive a guaranteed death benefit, ensuring their financial stability during difficult times. Additionally, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn, providing you with a financial resource in emergencies or for major expenses.

Investing in whole life insurance not only safeguards your family's future, but it also serves as a vital savings tool. The cash value component grows at a steady rate, making it a reliable investment compared to other fluctuating assets. By incorporating whole life insurance into your financial strategy, you can create a legacy for your loved ones while also enjoying the peace of mind that comes from knowing they will be protected, no matter what happens. This comprehensive approach ensures that your family's financial future remains secure, even in the face of life's uncertainties.