Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Whole Life Insurance: The Policy That Lives On

Discover the hidden benefits of whole life insurance and why it’s the financial safety net that keeps giving for generations!

What is Whole Life Insurance and How Does It Work?

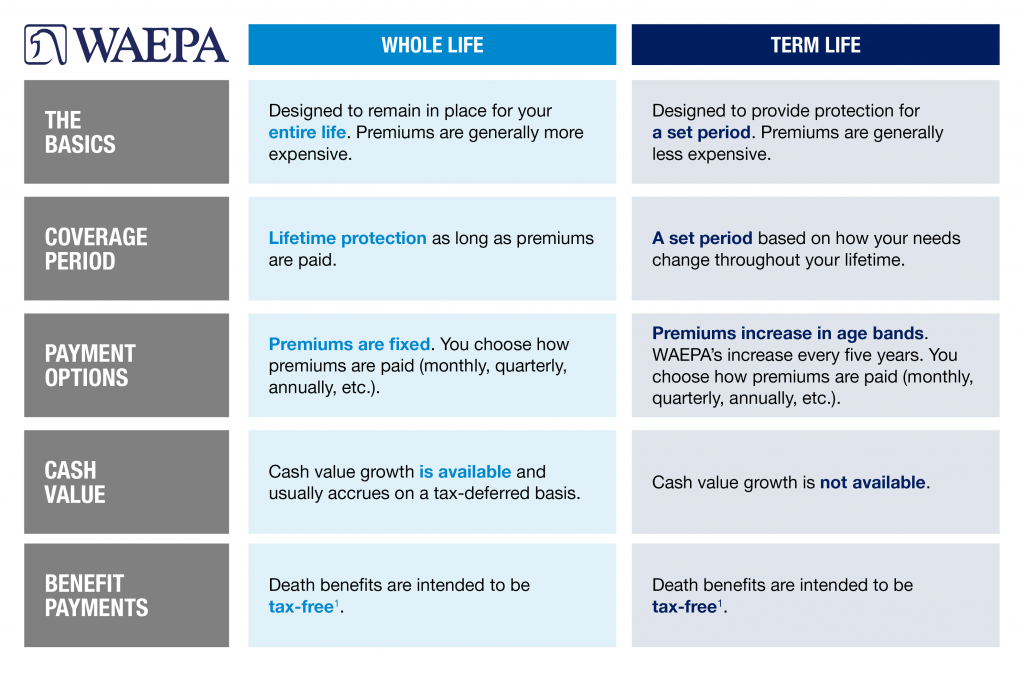

Whole Life Insurance is a type of permanent life insurance designed to provide coverage for the entirety of the policyholder's life, as long as premiums are paid. Unlike term life insurance, which expires after a set period, whole life insurance not only offers a death benefit to beneficiaries but also accumulates cash value over time. This cash value grows at a guaranteed rate, making it a valuable asset that can be accessed during the policyholder's lifetime through loans or withdrawals, although it's important to note that any outstanding loans will reduce the death benefit.

When purchasing a whole life insurance policy, there are several key components to consider. First, the premium payments are typically fixed and must be made consistently to keep the policy in force. Additionally, the cash value component is largely tax-deferred, allowing policyholders to grow their savings without immediate tax implications. Furthermore, many whole life insurance policies offer dividends from the insurer, which can be reinvested to further increase cash value or taken as cash. Overall, understanding how whole life insurance works can help individuals make informed decisions about their financial and estate planning needs.

The Benefits of Whole Life Insurance: Is It Right for You?

Whole life insurance offers a unique combination of lifelong coverage and a cash value component, making it a popular choice for individuals seeking financial security. One of the primary benefits of whole life insurance is that it provides guaranteed death benefits to your beneficiaries, ensuring that your loved ones are financially protected after your passing. Additionally, the cash value accumulation grows at a fixed rate over time, allowing you to borrow against it or withdraw funds in times of need. This dual benefit not only serves as a safety net but also as a savings tool, which can be especially valuable for long-term financial planning.

However, while whole life insurance has its advantages, it may not be suitable for everyone. It's essential to consider your individual financial situation and long-term goals before making a decision. For some, the higher premium costs associated with whole life insurance might be a drawback, especially when compared to term life insurance options. To determine if it is right for you, evaluate your current savings, expected expenses, and family needs. In some cases, consulting with a financial advisor can help clarify the best insurance choice tailored to your circumstances.

Debunking Myths: Common Misconceptions About Whole Life Insurance

Whole life insurance is often misunderstood, leading to several common misconceptions. One prevalent myth is that whole life insurance is a poor investment choice because of its higher premiums compared to term life options. However, this perspective overlooks the fact that whole life policies offer both a death benefit and a cash value component that grows over time. This cash value can be borrowed against or withdrawn in emergencies, providing a financial safety net that term policies don’t offer. Indeed, when considering the long-term benefits, whole life insurance can be a vital part of a comprehensive financial plan.

Another misconception is that whole life insurance is only for the wealthy. While it is true that whole life insurance generally requires a more substantial financial commitment, it can be an accessible option for many people with a solid understanding of their financial goals. In reality, individuals from various economic backgrounds can benefit from the predictable nature of whole life policies, which often serve not just as an insurance product but also as an essential savings tool. Engaging with a financial advisor can help potential policyholders grasp how whole life insurance fits into their overall financial landscape.