Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Why Paying Less for Auto Insurance Is Easier Than Parallel Parking

Discover simple tips to save on auto insurance and make it easier than mastering parallel parking. Unlock savings today!

Unlocking Savings: Tips for Finding Cheap Auto Insurance

Finding cheap auto insurance can be a daunting task, but with the right strategies, you can unlock significant savings. Start by shopping around and comparing quotes from multiple providers. Websites like comparison tools or speaking with independent brokers can help you identify price differences. Additionally, consider adjusting your coverage limits and deductibles; increasing your deductible can lower your premium, but make sure it aligns with your budget in case of a claim.

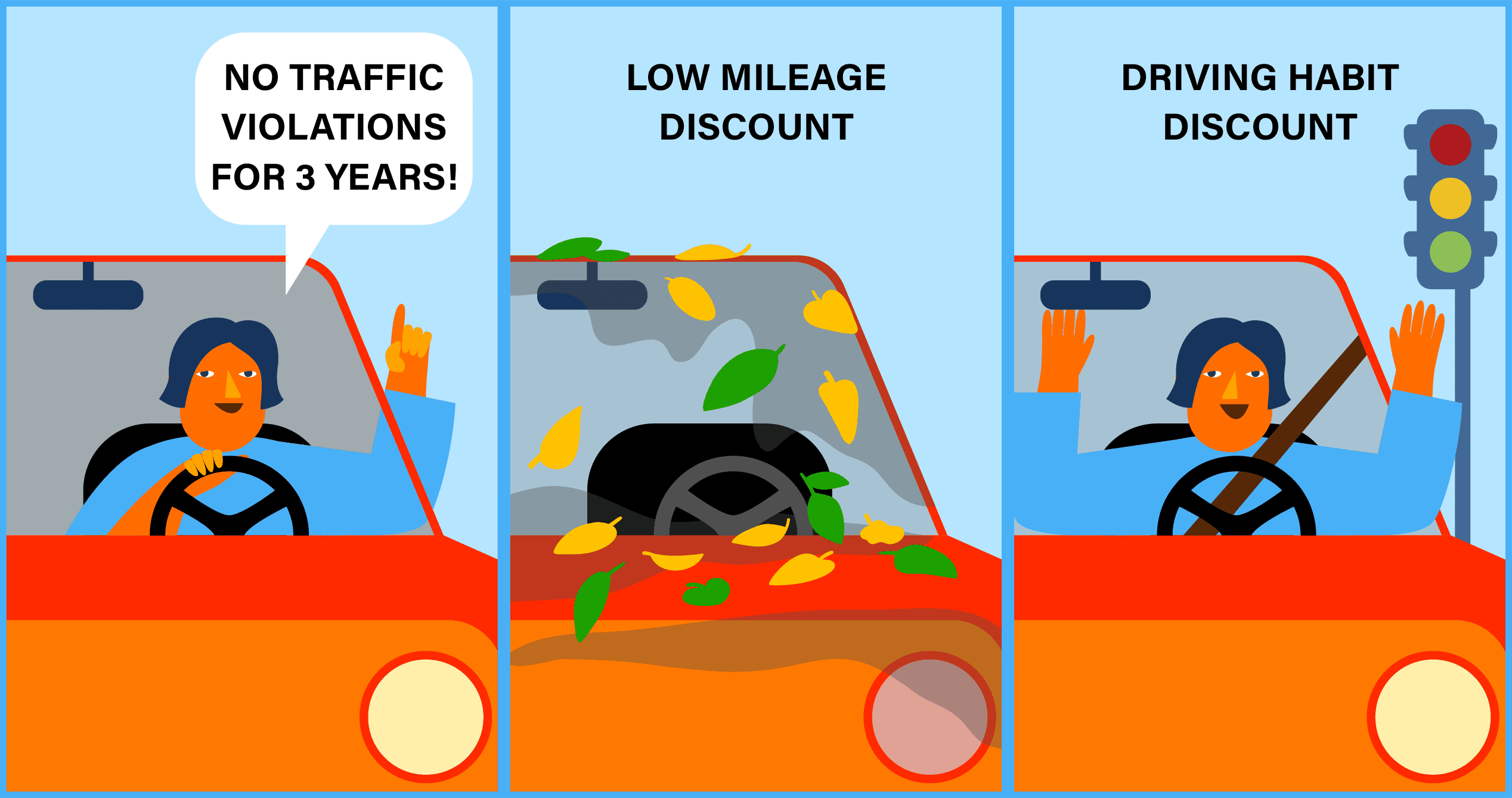

Another effective way to secure cheap auto insurance is to take advantage of discounts offered by insurers. Many companies provide reductions for safe driving records, bundled policies, or even for completing defensive driving courses. To maximize your savings, ask your insurer about all the available discounts and ensure you’re taking full advantage of them. Furthermore, maintaining a good credit score can also positively impact your premium, making it essential to manage your finances wisely.

The Simplified Guide to Comparing Auto Insurance Rates

When it comes to choosing the right auto insurance, comparing rates is essential. A simplified guide can help streamline this process. Start by gathering quotes from multiple insurance providers. Use online comparison tools or get in touch with agents to collect necessary information such as coverage options, deductibles, and premiums. This step ensures that you have a clear view of the market rates and can easily identify which policies offer the best value for your needs.

Next, analyze the quotes based on your individual driving habits and circumstances. Consider factors such as your driving record, the type of vehicle you own, and your coverage requirements. Create a simple comparison chart listing each insurance provider alongside key details of their offerings. This visual representation will help you quickly spot differences, allowing you to make an informed decision without becoming overwhelmed by the multitude of choices available.

Common Myths About Auto Insurance: What You Need to Know

When it comes to auto insurance, many people hold common myths that can lead to confusion and poor decision-making. For instance, one prevalent myth is that price is the only factor to consider when choosing an auto insurance policy. In reality, factors such as coverage limits, deductibles, and customer service quality are equally important. Relying solely on cost can result in inadequate coverage, leaving drivers vulnerable in the event of an accident.

Another misunderstanding is that having a good driving record automatically guarantees the best rates. While a clean driving history can certainly help, it is not the only criterion insurers use to assess risk. Factors like credit history, location, and even the type of vehicle you drive also play a significant role in determining your premium. Therefore, it’s essential to dispel these myths about auto insurance and approach your policy options with a comprehensive understanding of how various elements interact.