Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Why Your Next Big Decision Should Start with Insurance Quotes

Unlock the secret to smarter decisions! Discover why insurance quotes should be your first step before making any big choice.

How Insurance Quotes Can Influence Your Important Life Choices

When making significant decisions in life, such as purchasing a home or planning for retirement, understanding the role of insurance quotes is crucial. These quotes provide not only an estimation of monthly or annual premiums but also insight into the level of coverage you can afford. By evaluating various insurance quotes, you can better assess your financial situation and prioritize essential expenses. For instance, comparing homeowners insurance quotes can help you choose the right policy that protects your investment while aligning with your budget.

Moreover, insurance quotes can serve as a practical tool for evaluating different life choices. For example, when considering starting a family, obtaining health insurance quotes can reveal the most suitable plans for prenatal and pediatric care. Additionally, having comprehensive coverage can influence whether you feel secure enough to take risks, like starting a new business. By analyzing these quotes, you can make informed decisions that not only cater to your current needs but also shape your future aspirations.

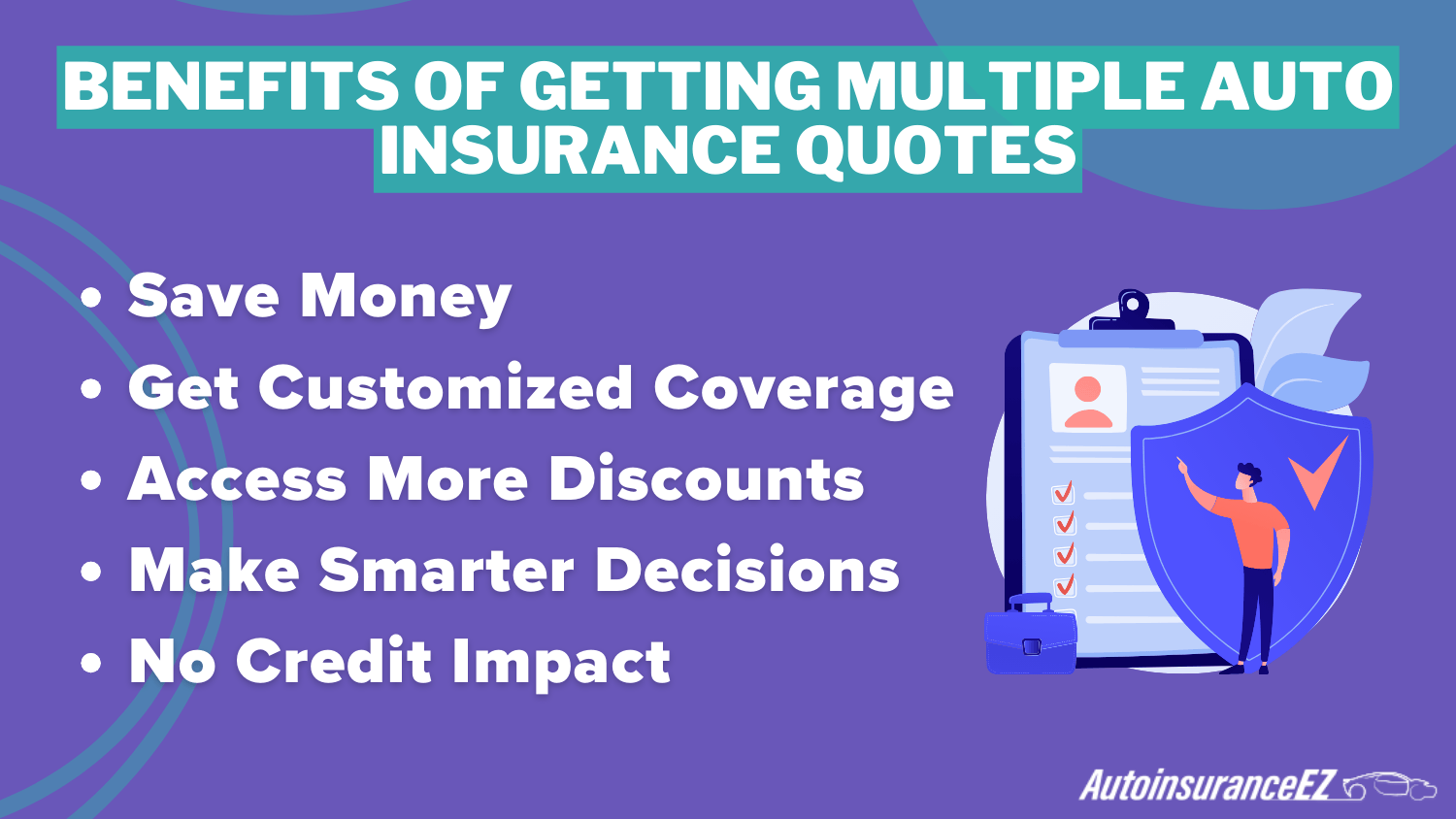

The Top 5 Reasons to Get Insurance Quotes Before Making Big Decisions

Making significant financial decisions without the right information can lead to costly mistakes. That's why obtaining insurance quotes should be on your to-do list before finalizing any major purchase—be it a home, vehicle, or even starting a business. Here are the top reasons why you should prioritize getting these quotes:

- Financial Clarity: Understanding the costs associated with insuring your new investment helps in budgeting accurately.

- Comparative Analysis: Different insurance providers offer various rates and coverage options; obtaining multiple quotes allows you to compare and find the best deal.

- Better Financial Decision: Insurance can significantly impact your overall financial situation; knowing the right premiums can help you avoid overextending yourself.

- Coverage Understanding: Getting quotes gives you insights into what is included and excluded from policies, ensuring you select the coverage that meets your needs.

- Peace of Mind: Knowing that you have adequate coverage in place enhances your confidence as you make big decisions that could impact your financial future.

What You Need to Know: How Insurance Quotes Shape Your Financial Future

When considering your financial future, understanding insurance quotes is paramount. Insurance quotes play a crucial role in determining the costs and coverage options available to you, making them a key factor in your overall financial planning. By comparing multiple quotes, you can identify the best policies that fit your needs and budget, which can ultimately lead to significant savings. Moreover, different providers may offer varying rates based on your unique circumstances, such as your age, location, and driving history, so it's important to take the time to explore your options thoroughly.

Additionally, the implications of making an uninformed decision regarding insurance quotes can be long-lasting. For instance, opting for the lowest-priced quote without assessing the coverage can leave you vulnerable in the face of unforeseen circumstances. It's crucial to consider not just the price, but also the extent of coverage, customer service reputation, and claims process of the insurance provider. By carefully selecting your insurance, you can safeguard your financial future, ensuring that you have the support you need in times of crisis.