Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Life Insurance: A Safety Net or Just Another Bill?

Discover if life insurance is your ultimate safety net or just another monthly bill draining your wallet. Dive in to find out!

Understanding Life Insurance: Is It a Safety Net for Your Family?

Understanding life insurance is crucial for anyone looking to provide financial security for their loved ones. Life insurance acts as a safety net that ensures your family is protected in the event of an unforeseen tragedy. With the right policy, your beneficiaries can receive funds that can cover essential expenses such as mortgage payments, children's education, and daily living costs. This financial support can make all the difference during a challenging time, allowing your family to focus on healing rather than worrying about finances.

When considering a life insurance policy, it’s important to evaluate your family’s financial needs and potential future expenses. There are several types of life insurance to consider, including term life and whole life policies. Term life insurance provides coverage for a specified period, while whole life insurance offers lifelong protection with a cash value component. By understanding the different options and assessing your family's needs, you can determine the best plan to ensure that your loved ones have a solid safety net in place should anything happen to you.

The True Cost of Life Insurance: Is It Just Another Bill?

When considering life insurance, many individuals perceive it as just another monthly bill to add to their growing list of expenses. However, it's essential to understand the true cost of life insurance beyond its premium payments. This cost includes not only the money spent on the policy but also the peace of mind it brings to you and your loved ones. In fact, the financial safety net that life insurance provides can outweigh the perceived burden of its ongoing costs.

Moreover, there are various factors that influence the overall cost of life insurance, including age, health, and the type of coverage you choose. For instance, term life insurance generally offers lower premiums compared to whole life insurance, but each option serves different needs. When weighing the true cost, consider forming a comprehensive view by evaluating your personal financial situation and whether the benefits of life insurance align with your long-term goals—transforming it from just another bill into a valuable investment in your family's future.

Life Insurance Myths: What You Need to Know Before You Buy

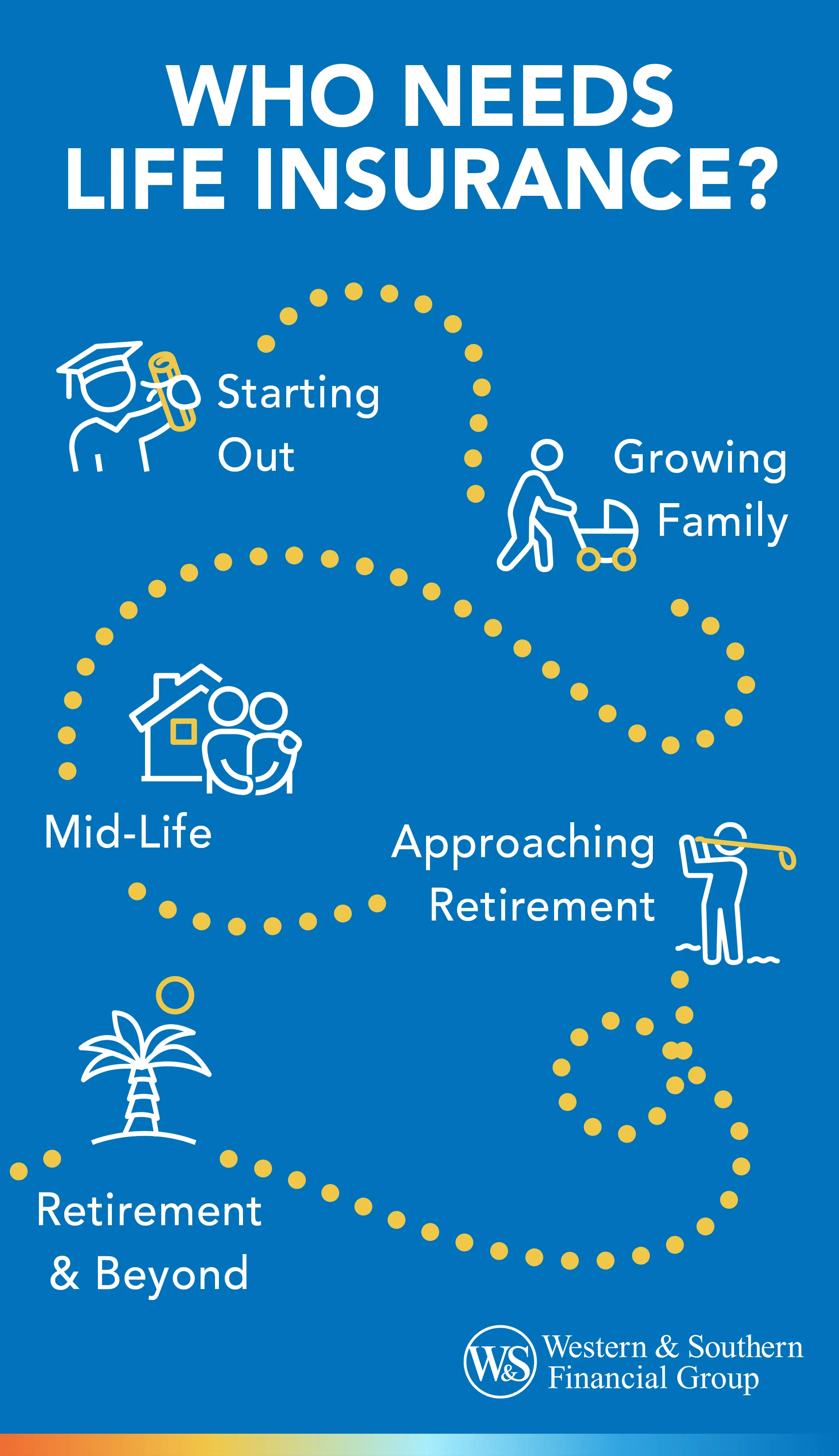

When considering life insurance, many people fall prey to common myths that can cloud their judgment. One prevalent myth is that life insurance is only necessary for the elderly or those with dependents. In reality, purchasing life insurance at a younger age can lock in lower premiums and provide financial security for your loved ones, regardless of your current situation. It's crucial to understand the different types of life insurance policies available, as they can serve various needs, such as covering debts or providing income replacement.

Another widespread misconception is that life insurance is too expensive for the average person. However, many overestimate the cost and fail to explore the options available to them. In fact, term life insurance can be quite affordable and accessible for many individuals. To truly grasp the financial commitment involved, it is essential to evaluate your personal circumstances, needs, and budget. Educating yourself on these myths will empower you to make informed decisions when purchasing life insurance.