Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

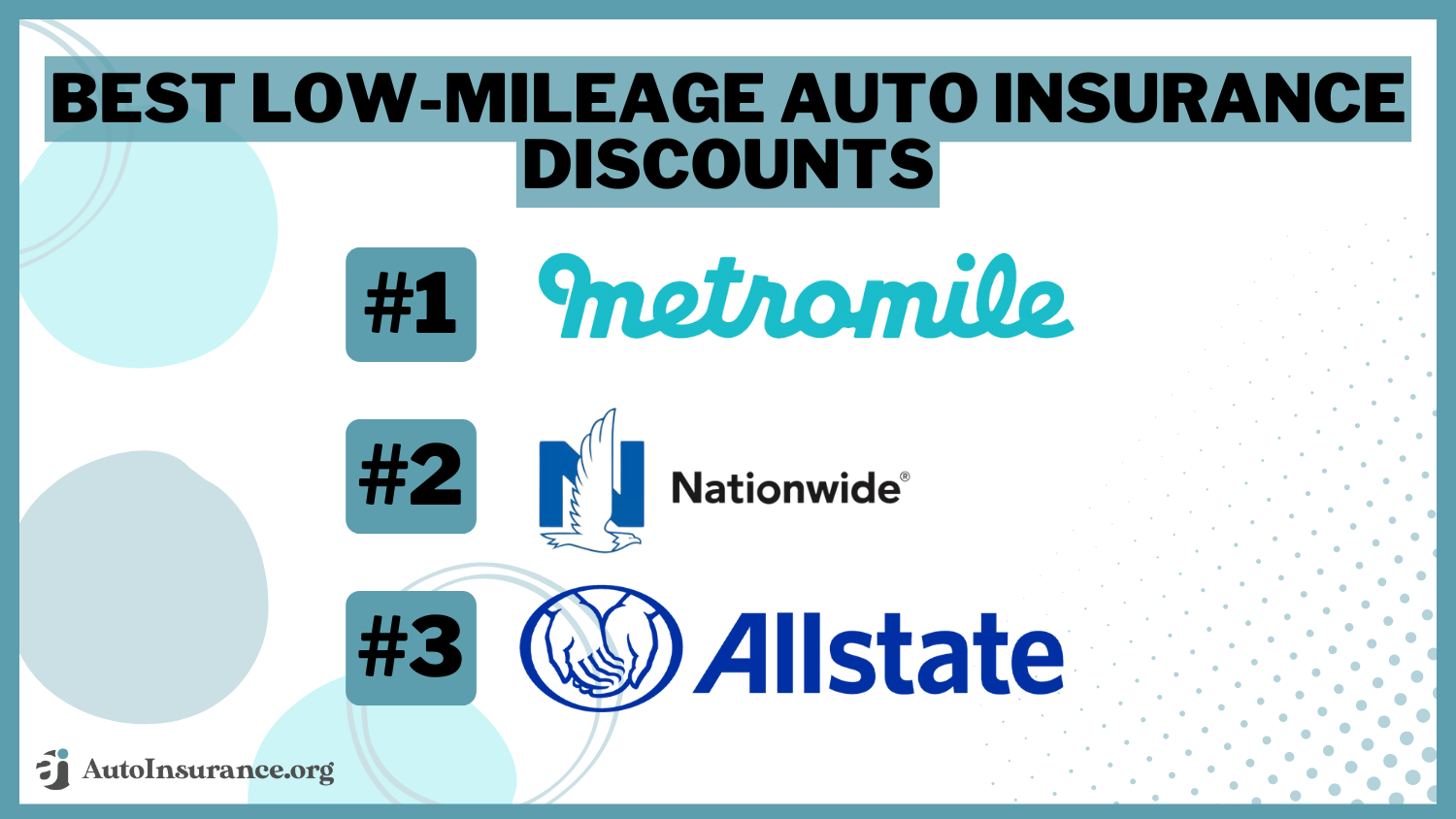

Discounts That Drive Down Your Premiums

Unlock hidden discounts to slash your premiums! Discover tips to save big on your insurance today!

Maximizing Savings: How to Find Discounts That Lower Your Insurance Premiums

Finding discounts that can help lower your insurance premiums is essential for maximizing your savings. Many insurance providers offer a variety of discounts that you may not be aware of. Start by evaluating your current policies; look for bundling discounts that reward you for purchasing multiple types of insurance, such as auto and home. Additionally, inquire about safe driver discounts if you maintain a clean driving record, as well as discounts for being claims-free for a certain period. Each of these discounts can significantly reduce your overall premiums.

Another effective strategy to discover potential discounts is to ask about lifestyle discounts. Factors such as your occupation, affiliations, or even your loyalty to a specific insurer can result in premium reductions. For instance, some companies offer discounts to members of certain organizations or alumni groups. Comparing quotes from different insurers can also reveal varying discount opportunities, allowing you to choose the policy that offers the best overall value. Don’t hesitate to negotiate with your insurance agent or shop around to ensure you are maximizing your savings on premiums.

Unlocking Hidden Discounts: Are You Missing Out on Premium Reductions?

Unlocking hidden discounts can transform your shopping experience, revealing savings you might not even know existed. Many retailers offer premium reductions that are often buried in promotional emails, loyalty programs, or membership benefits. By taking the time to explore these avenues, you not only maximize your savings but also gain access to exclusive offers that can enhance your purchasing power. Don't just settle for the typical sales and clearance sections; delve deeper into the world of discounts by subscribing to newsletters and joining reward programs, which can yield impressive savings on your favorite products.

To ensure that you’re not missing out on potential savings, consider implementing a few strategic steps. Start by creating a checklist of your favorite brands and regularly checking their websites for hidden deals. Additionally, familiarize yourself with discount codes that may be available online; simple searches can often uncover valuable offers. Lastly, don’t underestimate the power of social media—many companies post flash sales or exclusive promo codes on their platforms. By adopting a proactive approach to uncovering premium reductions, you can unlock hidden discounts and significantly enhance your overall shopping experience.

The Ultimate Guide to Insurance Discounts: What You Need to Know to Save

The Ultimate Guide to Insurance Discounts reveals a plethora of opportunities to save on your insurance premiums. Many policyholders are unaware that various discounts are available that can significantly reduce costs. Insurance discounts can range from bundling policies to safe driving rewards. To start maximizing your savings, consider these common types of discounts:

- Bundling Discounts: Combine multiple policies, like auto and home insurance, for a reduced rate.

- Safe Driver Discounts: Remain accident-free for a certain period to qualify for lower premiums.

- Good Student Discounts: Students maintaining a high GPA can enjoy significant savings on their car insurance.

Additionally, insurance providers often offer discounts for specific affiliations or situations. For example, membership in certain organizations or professions may lead to exclusive discounts. Another effective way to reduce costs is by reviewing your policy annually to ensure you're not missing out on any available savings. Always ask your insurer about any potential discounts, as policies may change, and new offers can emerge. Remember, every little bit helps, so take advantage of all the insurance discounts you can find!