Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

How to Slash Your Auto Insurance Bill Like a Pro

Discover expert tips to dramatically reduce your auto insurance costs and keep your hard-earned money in your pocket!

Top 10 Secrets to Reducing Your Auto Insurance Premium

Saving on your auto insurance premium can be easier than you think. Here are the Top 10 Secrets to Reducing Your Auto Insurance Premium that every driver should know. First, consider comparing quotes from multiple insurance providers. Rates can vary significantly, and finding the best deal could save you hundreds of dollars. Additionally, bundling your auto insurance with other types of insurance, like homeowners or renters insurance, often leads to substantial discounts.

Another effective way to lower your premium is to maintain a clean driving record. Insurance companies reward safe drivers with lower rates, so being cautious on the road can pay off over time. Furthermore, taking a defensive driving course can not only enhance your skills but may also qualify you for further discounts. Lastly, review your coverage needs periodically. As your circumstances change, you may be able to adjust your coverage to reflect your current situation and save money in the process.

Is Your Auto Insurance Too High? Here’s How to Find Out!

Are you feeling the pinch when it comes to your auto insurance premiums? It’s essential to evaluate whether you are paying more than necessary for your coverage. Start by reviewing your current policy details, including coverage limits, deductibles, and any additional features. Make a list of the discounts you may qualify for, such as safe driver discounts, multi-policy discounts, or low mileage discounts. By going through this information, you will have a clearer picture of your current auto insurance costs and whether there are opportunities for savings.

To further assess if your auto insurance is too high, consider obtaining quotes from multiple insurance providers for similar coverage. This allows you to compare prices and find competitive rates. Additionally, evaluate your driving habits and vehicle needs—if you rarely use your car, consider switching to a usage-based insurance plan, which can significantly reduce your premiums. Lastly, don’t hesitate to reach out to your current insurer to discuss potential adjustments to your policy. They may be able to offer lower rates or recommend changes to help you save.

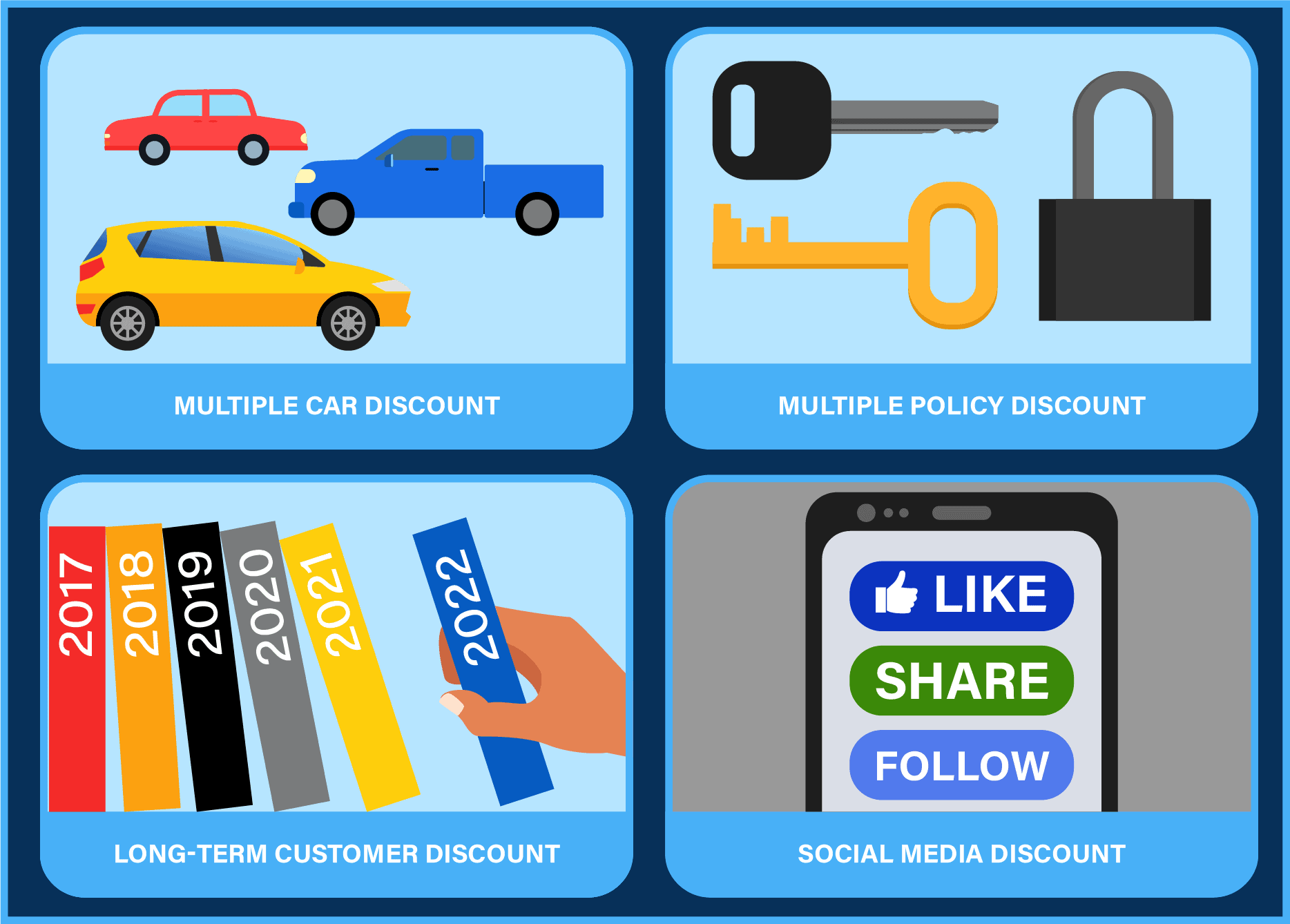

Unlocking Discounts: How to Save Big on Your Car Insurance

Saving on car insurance doesn't have to be a daunting task. By understanding the various discounts available, you can significantly lower your monthly premium. Insurers often offer discounts for things like maintaining a good driving record, bundling policies, or even completing a defensive driving course. Additionally, don't overlook the impact of your vehicle's safety features; cars equipped with advanced safety systems may qualify for reduced rates. Start by speaking with your insurance agent to identify which discounts you may be eligible for, and consider shopping around to compare offers from different insurers.

Another effective way to save big on your car insurance is to regularly review and update your policy. Your needs may change over time, and so do the opportunities for discounts. For instance, if you've moved to a safer neighborhood or if your vehicle has older technology that might lower its value, informing your provider can lead to potential savings. Additionally, consider raising your deductible; while this means you’ll pay more out of pocket in the event of a claim, it can lower your premium significantly. Remember, taking the time to evaluate your options can unlock substantial discounts and keep your budget in check!