Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance That Won't Break the Bank

Discover affordable insurance options that won’t drain your wallet! Save big while staying protected with our expert tips and tricks.

Top 5 Affordable Insurance Options for Every Budget

Finding affordable insurance can be a daunting task, especially with the variety of options available today. Whether you're looking for health insurance, auto insurance, or homeowners insurance, it’s essential to know what fits within your budget without sacrificing coverage. In this article, we’ll explore the top 5 affordable insurance options that cater to different financial situations, making it easier for you to make an informed choice.

- High-Deductible Health Plans (HDHP): HDHPs often come with lower monthly premiums, making them an attractive option for those who don't require frequent medical care.

- State Farm: Known for its competitive pricing, State Farm offers a range of auto insurance policies to suit various budgets and needs.

- Level Premium Life Insurance: This option provides coverage for the long term, guaranteeing a premium that remains constant over the life of the policy.

- Progressive: With its customizable policies, Progressive enables customers to find a package that meets their coverage needs while staying within budget.

- USAA: Exclusive to military members and their families, USAA offers some of the best rates for home and auto insurance.

How to Choose Budget-Friendly Insurance Without Sacrificing Coverage

Choosing budget-friendly insurance can seem daunting, especially when you're concerned about ensuring adequate coverage. Start by assessing your needs carefully. Consider your assets, lifestyle, and any specific risks you may face. For instance, if you drive less, you might not need the highest auto coverage. Creating a detailed list of what you want your coverage to achieve will help you *avoid over-insuring* while still protecting yourself appropriately.

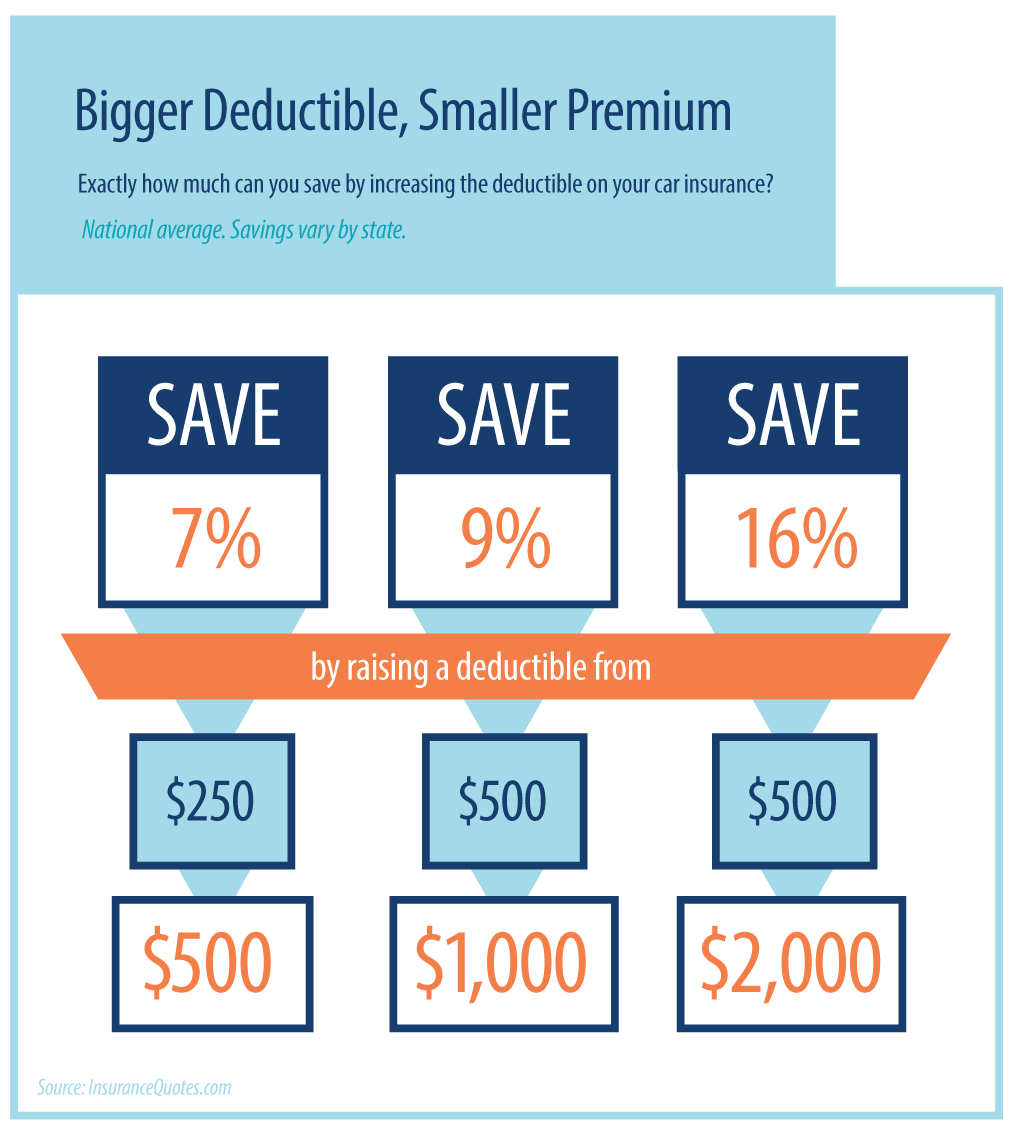

Next, compare multiple insurance quotes to find the best budget-friendly options. Utilize online comparison tools that can help aggregate offers from various insurers. While cost is a significant factor, it's essential to examine the coverage features included in each policy. Pay close attention to deductibles, limits, and any exclusions that may apply. This way, you ensure that you’re selecting a policy that meets your financial needs without sacrificing essential coverage.

Insurance Myths: What You Need to Know to Save Money

When it comes to insurance myths, many people fall prey to misconceptions that can cost them significantly. One common myth is that having a good driving record automatically means you'll secure the best rates on your auto insurance. In reality, insurance companies use a variety of factors when determining premiums, including credit history and the type of vehicle you drive. Another popular misconception is that life insurance is only necessary for older individuals or those with dependents. In fact, purchasing a policy at a younger age can save you money in the long run, as premiums are generally lower when you are healthier.

Understanding and debunking these insurance myths can lead to substantial savings. For example, many believe that bundling home and auto insurance will always yield the best discounts. While bundling can often lead to savings, it's essential to shop around and compare prices, as sometimes separate policies may be more cost-effective. Additionally, some people think that having a higher deductible will mean lower premiums; however, this could backfire if an unexpected event occurs, leading to out-of-pocket costs that exceed your savings. Always evaluate your unique situation and needs to make informed decisions about your coverage.