Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Insurance Shenanigans: The Discount Game

Uncover the wild world of insurance discounts! Discover tips, tricks, and secrets to save big in the Discount Game. Don't miss out!

Unlocking the Mystery: How to Navigate Insurance Discounts

When it comes to navigating insurance discounts, understanding the factors that contribute to your premiums is essential. Insurance companies often offer numerous discounts based on various criteria such as your driving record, the age of your vehicle, and even your credit score. It's crucial to communicate openly with your insurer to determine which specific discounts you might be eligible for. Additionally, you can utilize online tools and calculators that help you identify potential savings.

Another effective way to unlock various insurance discounts is to bundle your policies. Many providers offer significant discounts when you combine multiple types of coverage, such as home and auto insurance. Moreover, remaining claim-free for an extended period can also lead to a reduced premium. Consider attending defensive driving courses or installing safety features in your vehicle, as these actions may qualify you for additional discounts. By being proactive and informed, you can truly maximize your savings when it comes to insurance.

Are You Missing Out? Common Insurance Discounts Explained

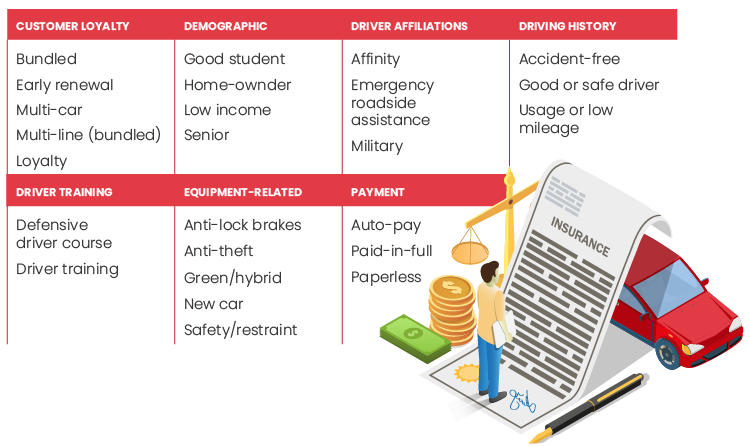

Many individuals overlook potential savings in their insurance premiums due to a lack of awareness about available discounts. Insurance discounts can significantly reduce your overall costs, but they often go unmentioned during the application process. Common discounts include multi-policy discounts, where bundling home and auto insurance can lead to savings. Other options may include safe driver discounts for maintaining a clean driving record, good student discounts for young drivers maintaining high grades, and loyalty discounts for long-term customers.

It's essential to actively inquire about these opportunities and compare different providers to ensure you receive the best deal possible. Insurance discounts can apply to various policies, including health, auto, and homeowners insurance. Don't hesitate to ask your agent about specific discounts that could be available to you, as many are unaware of how applicable they might be. Remember, maximizing your savings doesn't stop at discovering discounts; regular policy reviews can help you adjust coverage and find additional ways to lower your costs.

The Discount Game: Strategies to Maximize Your Insurance Savings

The Discount Game: Navigating the world of insurance discounts can seem overwhelming, but implementing effective strategies can help you maximize your savings. One of the first steps is to conduct a comprehensive review of your current policies. Ask your insurance agent about the various discounts available, which may include safe driver, multi-policy, or loyalty discounts. Additionally, consider bundling different types of insurance, such as auto and home, with the same provider to unlock lower rates and additional savings. Each insurer offers unique discounts, so it's essential to compare options and stay informed.

Another effective strategy to maximize your insurance savings is to actively maintain a good credit score, as many companies factor credit history into their pricing. Additionally, consider increasing your deductible, which can significantly lower your premium. Furthermore, staying with your insurance provider for multiple years often results in loyalty discounts. Finally, don't be afraid to shop around regularly; even small changes in your situation or the market can lead to substantial savings. Remember, the key is to remain proactive and knowledgeable about the various discount opportunities available in the insurance game.