Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Is Pet Insurance Worth It or Just a Flea Market Scam?

Discover the truth about pet insurance! Is it a smart investment or just a costly scam? Find out what you need to know before you buy!

Understanding the Benefits and Drawbacks of Pet Insurance

Understanding the benefits of pet insurance can help pet owners make informed decisions regarding their furry companions' health care. One of the primary advantages is financial protection against unexpected veterinary costs. According to the American Veterinary Medical Association, treatment for serious health issues can quickly add up, making pet insurance a valuable tool to ensure that you can afford necessary care without breaking the bank. Additionally, many policies offer the flexibility to choose your veterinarian, providing peace of mind that you can maintain the relationship with your trusted provider.

However, there are also some drawbacks to consider. For instance, many pet insurance policies come with exclusions, such as pre-existing conditions, which can limit coverage options. Furthermore, not all policies cover routine care and preventive treatments, which are essential for keeping pets healthy long-term. It's crucial to carefully review the terms before purchasing a policy as highlighted by Consumer Reports. Weighing both the benefits and drawbacks will help you determine whether pet insurance is the right choice for you and your pet.

Is Pet Insurance a Smart Investment for Your Furry Friend?

When considering whether pet insurance is a smart investment for your furry friend, it’s essential to evaluate the potential benefits. Pet insurance can help mitigate the financial burden of unexpected veterinary expenses, which can be substantial for major illnesses or accidents. According to the American Humane Association, pets requiring emergency care may incur bills that can range from hundreds to thousands of dollars. By investing in a plan that suits your needs, you can ensure your pet receives the best possible care without the stress of financial constraints.

Moreover, many pet insurance policies come with comprehensive coverage options that include routine care, preventative treatments, and emergency services. This can significantly reduce the overall healthcare costs for your pet over their lifetime. A survey by National Association of Pet Insurance Companies revealed that 60% of pet owners reported feeling more secure after purchasing coverage for their pets. In essence, having a reliable pet insurance plan establishes peace of mind, knowing your furry friend has access to necessary veterinary services at a moment's notice.

10 Questions to Ask Before Choosing Pet Insurance

Choosing the right pet insurance can be a daunting task for any pet owner. To ensure you make an informed decision, here are 10 questions you should ask:

- What types of coverage do you offer?

- Are there any exclusions or waiting periods?

- How do you determine premiums?

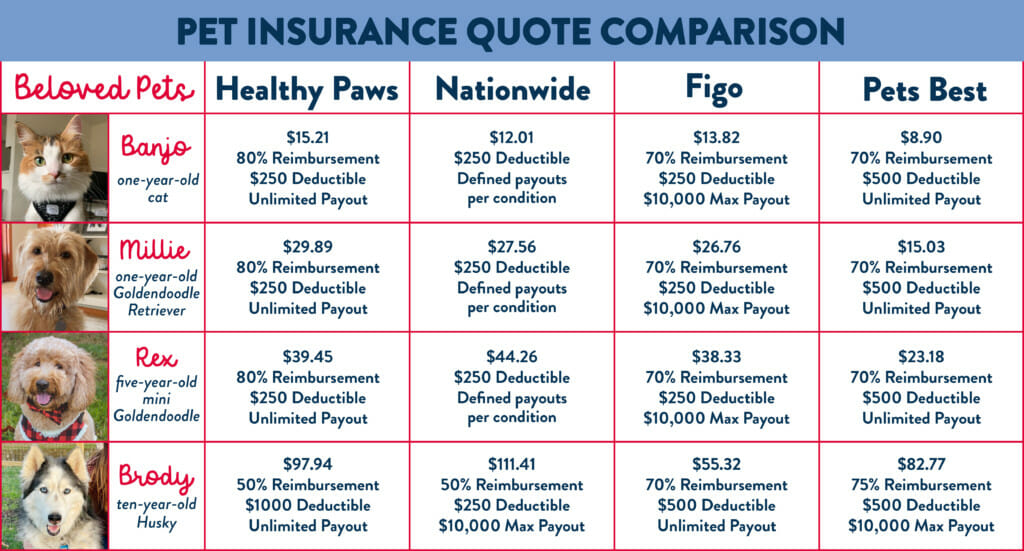

- Is there a cap on payouts?

- Can I choose my veterinarian?

- How do I file a claim?

- What happens if my pet develops a pre-existing condition?

- Do you offer multiple pet discounts?

- Are there breed-specific limitations?

- What is the customer service like?

By addressing these questions, you can gauge whether a particular insurance policy aligns with your pet’s needs. For more comprehensive information about pet insurance options, consider checking resources like the American Kennel Club which provides detailed insights on what to look for in a policy. Additionally, understanding the National Association of Insurance Commissioners can be beneficial when navigating the complexities of insurance plans tailored for pets.