Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden power of life insurance—your essential safety net! Find out why you can't afford to ignore this crucial protection.

Understanding Life Insurance: Key Benefits and How It Works

Understanding life insurance is crucial for securing your financial future and protecting your loved ones. It serves as a safety net that provides a death benefit to beneficiaries in the event of the policyholder's passing. This financial support can cover essential expenses such as mortgage payments, debts, and educational costs, ensuring that your family maintains their lifestyle even in your absence. Additionally, life insurance can accumulate cash value over time, which can be borrowed against or withdrawn, offering a source of funds for emergencies or investments.

Life insurance can be broadly categorized into two main types: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and is generally more affordable. In contrast, permanent life insurance, which includes whole life and universal life policies, offers lifelong protection and builds cash value. Choosing the right type requires careful consideration of your financial goals, family needs, and budget. By understanding these fundamental aspects, you can make an informed decision that aligns with your circumstances and offers peace of mind.

5 Common Misconceptions About Life Insurance Debunked

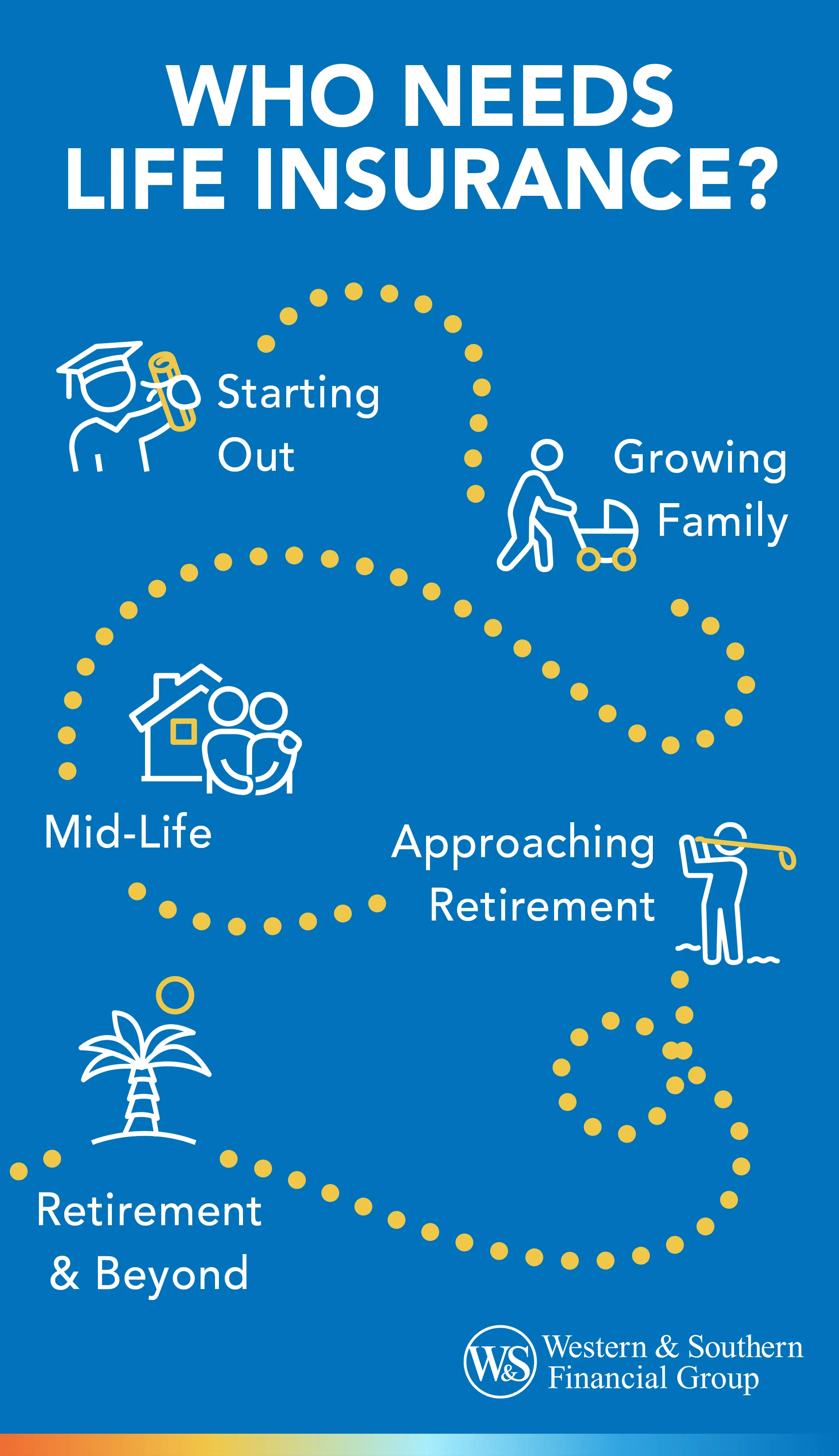

When it comes to life insurance, many people hold onto common misconceptions that can prevent them from making informed decisions. One prevalent myth is that life insurance is only necessary for those with dependents. In reality, anyone can benefit from life insurance, even if they are single or childless. It can help cover outstanding debts, ensure funeral costs are managed, or even serve as a financial tool for investment purposes. Understanding that life insurance can be a vital financial safeguard for anyone is the first step in debunking this myth.

Another misconception is that life insurance policies are too expensive. While costs can vary significantly based on age, health, and the type of policy chosen, many individuals might be surprised to learn that affordable options exist. In fact, term life insurance policies can be quite budget-friendly, allowing peace of mind without breaking the bank. Evaluating the variety of plans available and consulting with an insurance agent can help individuals find a policy that fits their needs and budget.

Is Life Insurance Right for You? 7 Questions to Consider

Deciding whether life insurance is right for you can be a complicated process, but asking yourself a few key questions can help clarify your needs. Start by considering your financial responsibilities. If you have dependents, such as children or a spouse, you'll want to evaluate how their financial future would be impacted if you were no longer around. It's important to think about whether your income is a crucial part of their lives and how much support they would need to maintain their lifestyle.

Next, reflect on your current and future financial obligations. Are there debts, such as a mortgage or student loans, that could burden your loved ones if you were to pass away? Additionally, consider your long-term goals. Would you like to leave a financial legacy, or cover expenses associated with your funeral? Answering these questions can guide you in determining if life insurance is a necessary addition to your financial planning.