Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

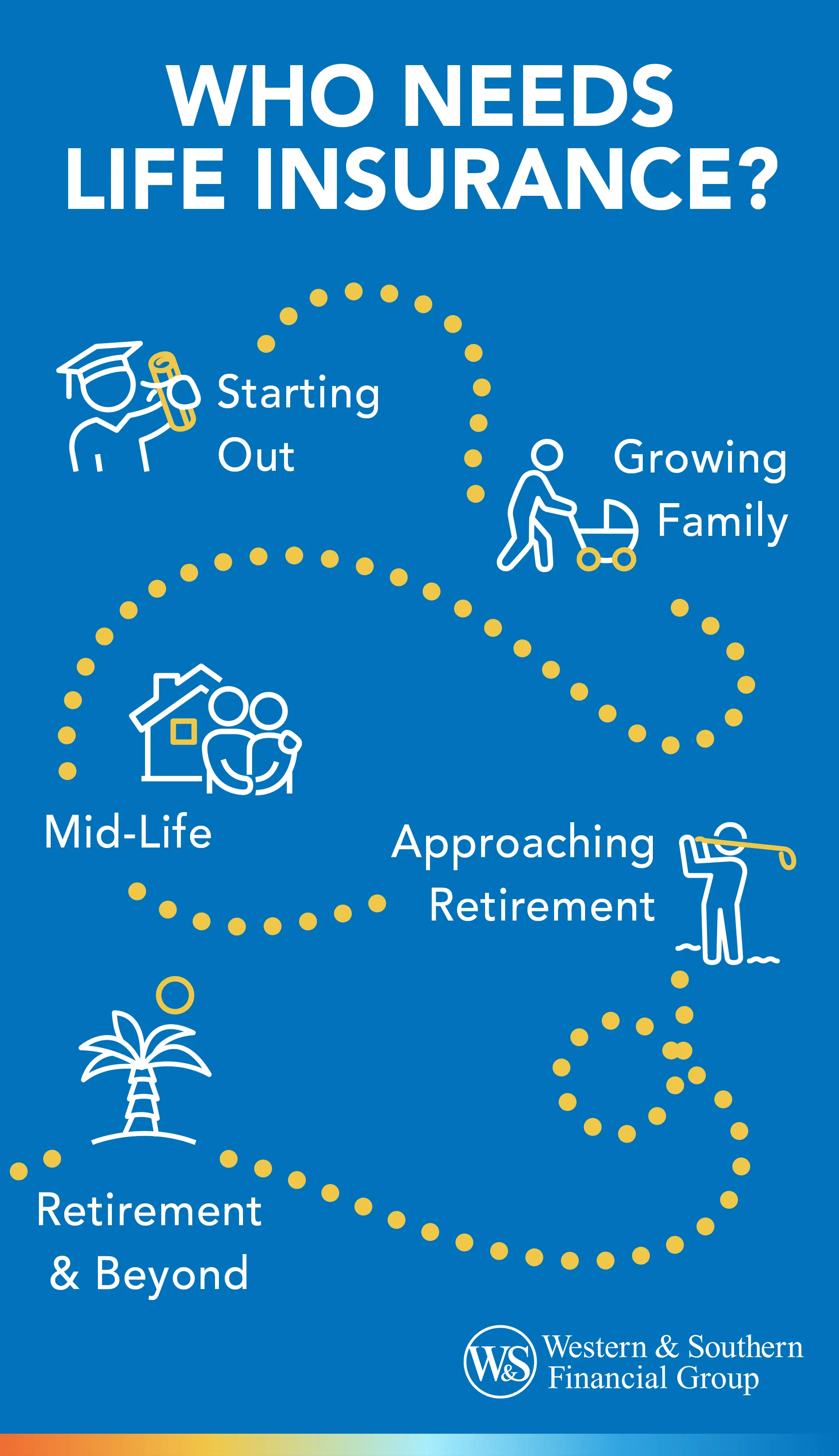

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the essential safety net you never knew you needed. Don’t leave your loved ones’ future to chance!

Understanding Life Insurance: Key Benefits and Frequently Asked Questions

Understanding life insurance is essential for anyone looking to secure their family's financial future. It acts as a safety net, providing monetary compensation to your beneficiaries in the event of your passing. The key benefits of having life insurance include financial protection, peace of mind, and the ability to cover debts and living expenses. With various types of life insurance policies available, such as term life, whole life, and universal life, individuals can choose the one that best aligns with their needs and financial goals.

Many people have frequently asked questions about life insurance, and it's crucial to address these queries. Some common questions include:

- What factors affect life insurance premiums?

- How much coverage do I need?

- Can I access the cash value of my policy?

The Importance of Life Insurance: How It Protects Your Loved Ones

Life insurance is a critical financial tool that provides peace of mind by ensuring the well-being of your loved ones in the event of an unforeseen tragedy. It acts as a safety net, alleviating the financial burdens that can arise from funeral costs, outstanding debts, and daily living expenses. When a primary earner passes away, the absence can create significant emotional and financial strain on surviving family members. With a life insurance policy in place, beneficiaries receive a death benefit that can cover these essential costs. This support allows them to focus on healing rather than worrying about immediate financial needs.

Beyond merely covering immediate expenses, life insurance serves as a strategic asset in long-term financial planning. The funds from a life insurance policy can be used to secure the future of your children’s education, preserve the family's home, or fund other essential financial commitments. Additionally, some policies offer a cash value component that can grow over time, providing a source of savings that can be accessed during your lifetime if needed. Therefore, investing in life insurance not only protects your loved ones in the short term but also lays the groundwork for their financial stability in the years to come.

Life Insurance Myths Debunked: What You Really Need to Know

Life insurance is shrouded in misconceptions that can lead to confusion and misinformation. One of the most prevalent myths is that life insurance is only necessary for older individuals or those with dependents. In reality, purchasing a policy at a younger age can be beneficial, as premiums are typically lower, and obtaining coverage can be easier with fewer health issues. Additionally, many people underestimate the importance of life insurance for clearing debts, such as mortgages or student loans, and ensuring financial stability for loved ones.

Another common myth is that life insurance is too expensive for the average person. In fact, there are various types of policies available that cater to different budgets and needs. Many individuals can find basic coverage for a modest monthly premium. Furthermore, it's crucial to understand that the right policy can provide peace of mind and a financial safety net for your family. By debunking these myths, you are better equipped to make informed decisions about your life insurance needs and understand its true value.