Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Protect Your Stuff: Why Renters Insurance is Your New Best Friend

Discover why renters insurance is your safety net! Protect your belongings and gain peace of mind today. Don’t wait until it's too late!

5 Reasons Renters Insurance is Essential for Your Peace of Mind

Renters insurance is often overlooked by tenants, yet it plays a crucial role in safeguarding both personal property and peace of mind. One significant reason to consider renters insurance is that it protects your belongings from unexpected events such as theft, fire, or water damage. In fact, without this coverage, you may face substantial financial loss if something were to happen to your possessions. Imagine coming home to find your apartment flooded or your valuables stolen; having renters insurance can alleviate the stress of replacing your items and give you the support you need during tough times.

In addition to covering personal property, renters insurance also provides liability protection, which is essential for any renter. Accidents can happen; for instance, if a guest slips and falls in your apartment, you could be held responsible for their medical expenses. With renters insurance, you can avoid financial strain from potential lawsuits and medical bills, allowing you to live more freely and confidently in your space. Ultimately, investing in renters insurance is a small price to pay for the peace of mind that comes with knowing you are financially protected against life's unpredictable events.

What Does Renters Insurance Actually Cover? A Comprehensive Guide

Renters insurance is a crucial safety net for individuals who lease their homes, offering financial protection against a variety of unexpected events. Typically, this type of insurance covers personal property, providing compensation for items that are stolen, damaged, or destroyed due to covered perils such as fire, theft, or vandalism. It's essential to check your policy for specific details, as coverage limits and deductibles can vary widely. In addition to personal property, many renters insurance policies also include liability protection, which can cover legal expenses if someone is injured in your rented space and decides to sue you.

Another significant aspect of renters insurance is coverage for additional living expenses (ALE). This comes into play when your rented home becomes uninhabitable due to a covered event, such as a fire or severe water damage. The insurance may cover costs like hotel stays, meals, and other necessary living expenses while your home is being repaired. It's important to understand that not all renters insurance policies are created equal, so reviewing your coverage options and understanding what is included is vital. This guide aims to demystify the essentials of renters insurance, ensuring you know what you're buying and how it protects your assets.

Is Renters Insurance Worth It? Common Myths Debunked

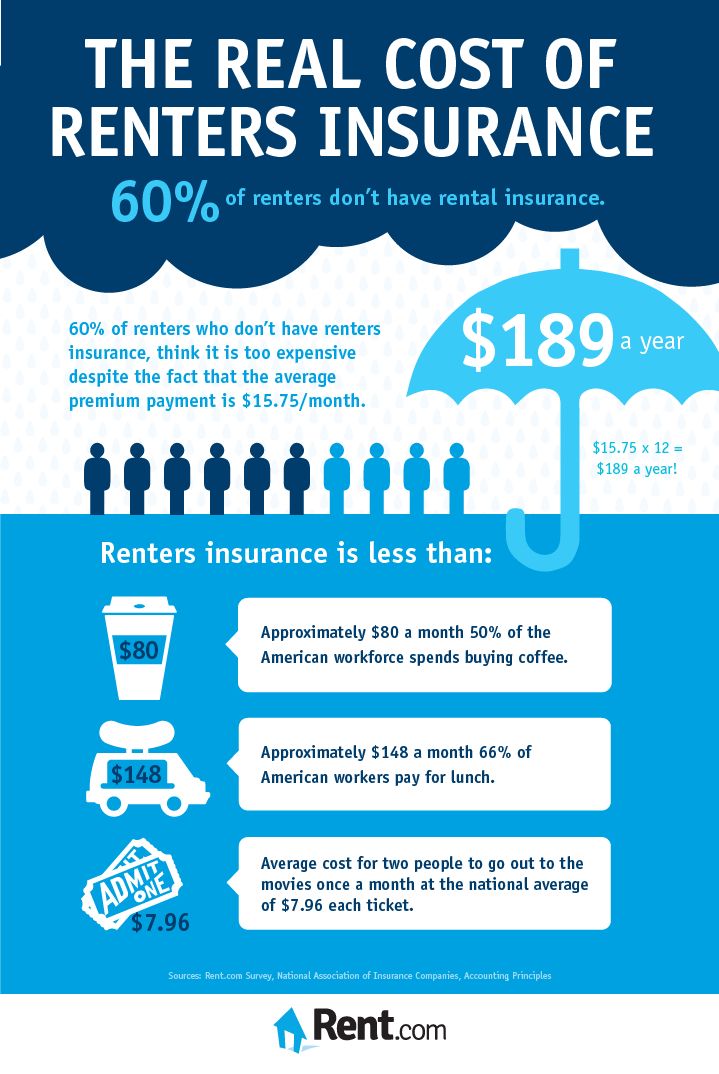

When considering whether renter's insurance is worth it, many people are influenced by common myths that can lead to misunderstandings about its value. One prevalent myth is that renter's insurance is unnecessary if you already have homeowner's insurance covering your belongings. However, this is not true—homeowner's insurance typically only protects the structure of the home, not your personal possessions in a rental unit. Without renter's insurance, you could face substantial financial loss in case of theft, fire, or other unforeseen events.

Another myth is that renter's insurance is too expensive. In reality, the average cost of renter's insurance is quite affordable, often ranging from $15 to $30 per month, depending on various factors such as location and coverage amount. This minimal monthly expense can provide you with peace of mind and financial protection against tenant liability and personal property loss. Ultimately, the benefits of having renter's insurance far outweigh the cost, debunking the myth that it is an unnecessary luxury.