Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Renters Insurance: Because Your Landlord's Coverage Won't Save Your Cat

Protect your furry friend and your valuables! Discover why renters insurance is essential—even if your landlord’s coverage isn’t enough.

Why You Need Renters Insurance: Protecting Your Belongings and Pets

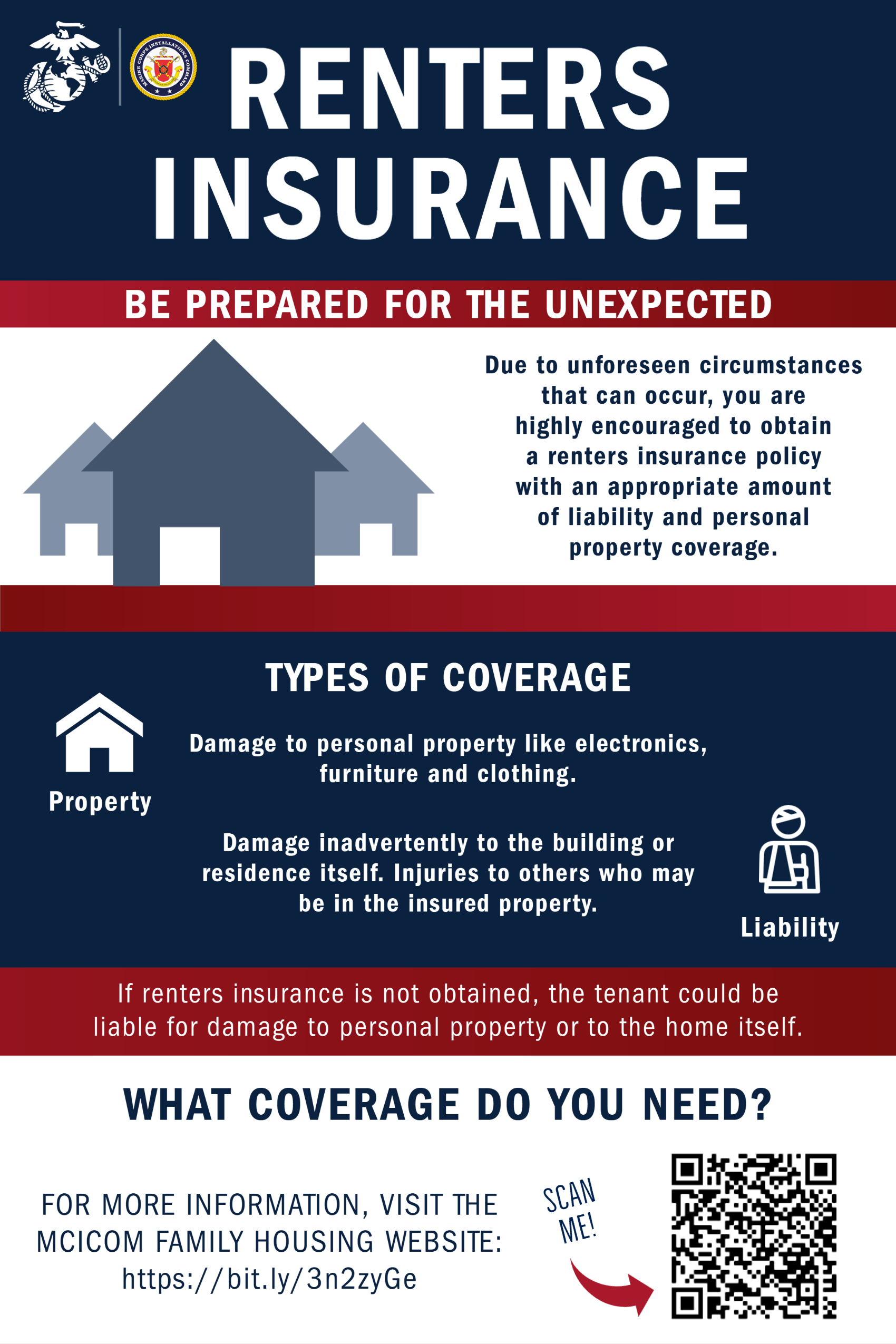

Renters insurance is often overlooked, yet it plays a crucial role in safeguarding your personal belongings against unforeseen events. Whether it's a fire, theft, or water damage, having this type of coverage ensures that you are financially protected. With renters insurance, you won't have to bear the burden of replacing your expensive electronics, furniture, and personal items out of pocket. Additionally, many policies extend coverage to provide protection for your belongings outside of your home, giving you peace of mind when you're out and about.

Moreover, renters insurance can also cover your furry friends. Many policies provide liability coverage if your pet accidentally injures someone or damages property. This is particularly important given that pet-related incidents can lead to hefty expenses. By choosing renters insurance, you not only protect your belongings but also ensure your pets are covered, allowing you to focus on enjoying your life without worrying about potential financial setbacks.

Common Myths About Renters Insurance Debunked

Many tenants hold myths about renters insurance that can lead to misunderstandings about its significance and coverage. One common belief is that if you live in a rental unit, your landlord’s insurance will cover your personal belongings. However, this is false; the landlord's insurance typically only covers the building structure and not your individual possessions. Without renters insurance, you could be left vulnerable to loss in the event of theft, fire, or natural disasters.

Another prevalent myth is that renters insurance is too expensive. In reality, the cost is often quite affordable, averaging about $15 to $30 per month, depending on the level of coverage. This small investment can provide invaluable protection for your belongings and even offer liability coverage in case someone is injured in your apartment. By debunking these common myths about renters insurance, tenants can make more informed decisions to protect what matters most to them.

What Does Renters Insurance Actually Cover?

Renters insurance provides crucial protection for individuals renting their homes, covering various types of personal property. Typically, it safeguards against damage or loss resulting from perils such as fire, theft, vandalism, and certain natural disasters. For example, if your electronics are stolen or your furniture is damaged due to a covered event, renters insurance can compensate you for repairs or replacement costs. Additionally, it includes liability coverage, which can protect you from financial responsibility if someone is injured in your rented space or if you accidentally cause damage to someone else's property.

Moreover, many renters insurance policies also offer additional living expenses (ALE) coverage. This means that if your rental becomes uninhabitable due to a covered incident, the insurance may cover costs associated with temporary housing and meals. It's essential to read your policy thoroughly to understand the extent of your coverage, limitations, and any deductibles that may apply. By ensuring you have the right policy in place, you can safeguard your belongings and achieve peace of mind while renting.