Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Score Big Savings with These Sneaky Auto Insurance Discounts

Unlock hidden auto insurance discounts and save big! Discover clever tricks to lower your premiums now!

Unlock Hidden Auto Insurance Discounts: What You Need to Know

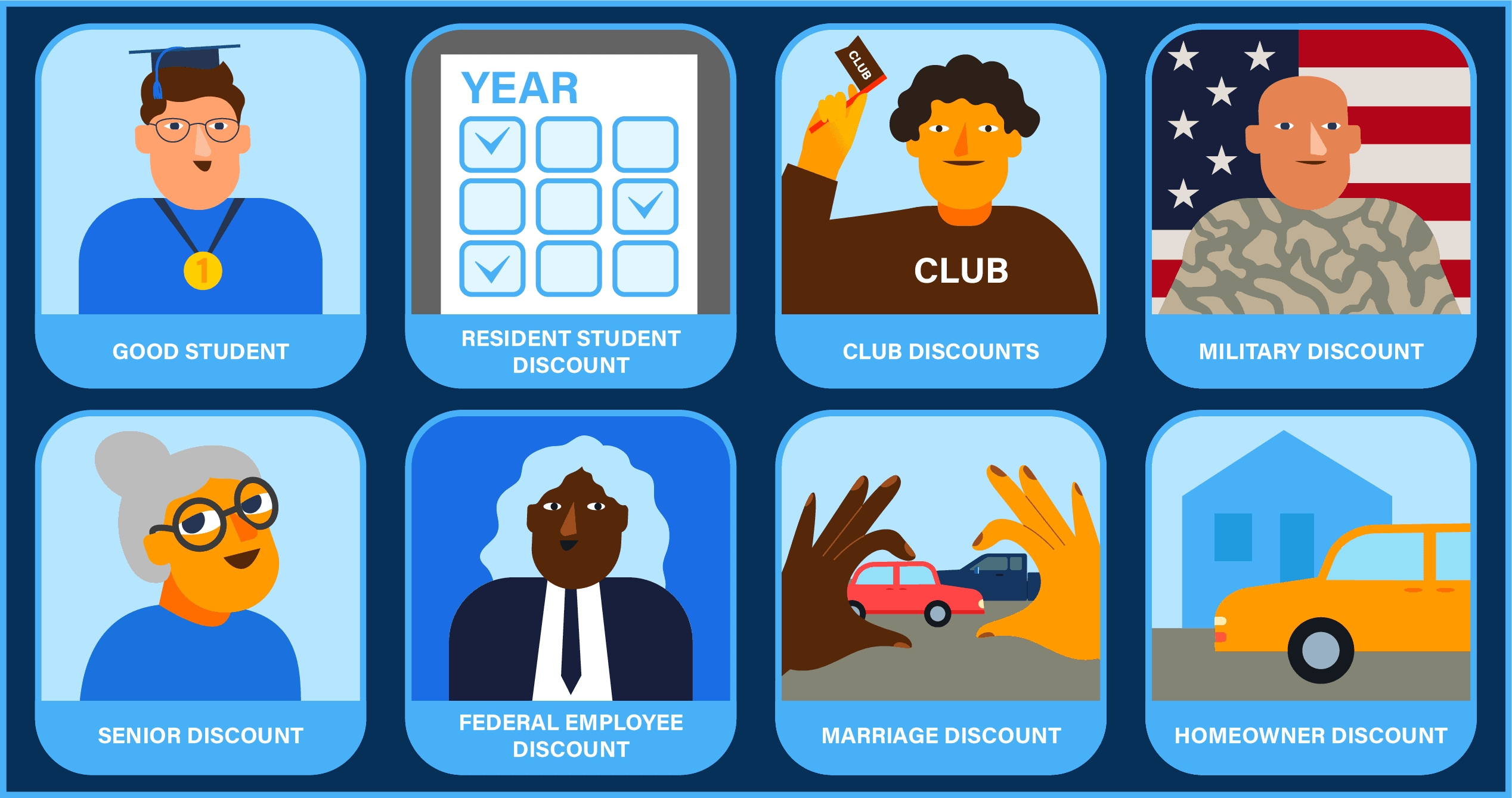

Auto insurance discounts can significantly lower your premium, but many drivers remain unaware of the options available to them. Understanding how to unlock hidden auto insurance discounts is crucial for saving money without sacrificing coverage. Common discounts include those for safe driving records, multiple policies, and even certain car safety features. Before renewing your policy or shopping for new insurance, make sure to inquire about potential discounts you might qualify for.

Additionally, consider leveraging community affiliations, such as memberships in professional organizations or alumni groups, as they often provide access to exclusive auto insurance discounts. Don't hesitate to ask your insurance agent about available discounts for low mileage or rewarding programs that track your driving habits. By taking these proactive steps, you can effectively maximize your savings and ensure you’re getting the best deal on your auto insurance.

10 Sneaky Ways to Save on Your Auto Insurance Premium

Saving on your auto insurance premium doesn't have to be a daunting task. Here are 10 sneaky ways that can help you reduce those pesky monthly payments:

- Shop Around: Don't settle for the first quote you receive. Comparing rates from multiple insurance companies can often lead to better deals.

- Bundle Your Policies: Many insurers offer discounts if you combine your auto insurance with other policies, like home or renters insurance.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. Just make sure you can afford the out-of-pocket expense in case of an accident.

- Utilize Discounts: Inquire about available discounts, such as those for good students, safe drivers, or using a vehicle equipped with safety features.

- Limit Your Mileage: If you drive less than the average mileage, report this to your insurer as lower usage can qualify you for a lower premium.

Additionally, consider the following strategies for even more savings:

- Maintain a Good Credit Score: Insurers often consider credit history when determining premiums; a better score can mean lower rates.

- Take a Defensive Driving Course: Completing a state-approved defensive driving course can sometimes lead to discounts on your insurance.

- Review Your Coverage: Regularly assess your coverage needs; if you own an older car, it might not be cost-effective to maintain full coverage.

- Ask About Pay-Per-Mile Insurance: For infrequent drivers, pay-per-mile insurance can significantly lower costs by charging based on actual miles driven.

- Choose a Vehicle Wisely: When purchasing a new car, research how different models impact insurance premiums, as some are more affordable to insure than others.

Are You Missing Out on These Common Auto Insurance Discounts?

Are you aware that many auto insurance providers offer discounts that you might be missing out on? These common discounts can significantly reduce your premiums and help you save money over time. For example, some insurers provide multi-policy discounts if you bundle your auto insurance with other policies, such as home or life insurance. Additionally, if you have a good driving record, you may qualify for a safe driver discount, encouraging safe driving habits while rewarding you financially.

Another often overlooked opportunity for savings is the good student discount, which is available for students who maintain a high GPA. This discount acknowledges the responsibility of young drivers and promotes education. Furthermore, many insurers also offer discounts for vehicles equipped with certain safety features, like anti-lock brakes and stability control. Don’t forget to ask your insurance agent about any available discounts that you could be eligible for, as taking advantage of these savings can decrease your overall insurance costs significantly!