Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

The Secrets to Slash Your Premiums

Unlock hidden tips to slash your premiums! Discover secrets that can save you big on insurance costs today!

10 Proven Strategies to Reduce Your Insurance Premiums

Reducing your insurance premiums is essential for saving money without compromising on coverage. Here are 10 proven strategies that can help you lower your costs:

- Shop Around: Regularly compare quotes from different insurers to find the best deal.

- Increase Your Deductible: Opting for a higher deductible can significantly reduce your premium. Just ensure you can afford the deductible if you need to file a claim.

- Bundle Policies: Many insurers offer discounts if you purchase multiple policies, such as home and auto insurance, from them.

- Maintain a Good Credit Score: A higher credit score can lead to reduced premiums, as insurers often use credit scores in their pricing.

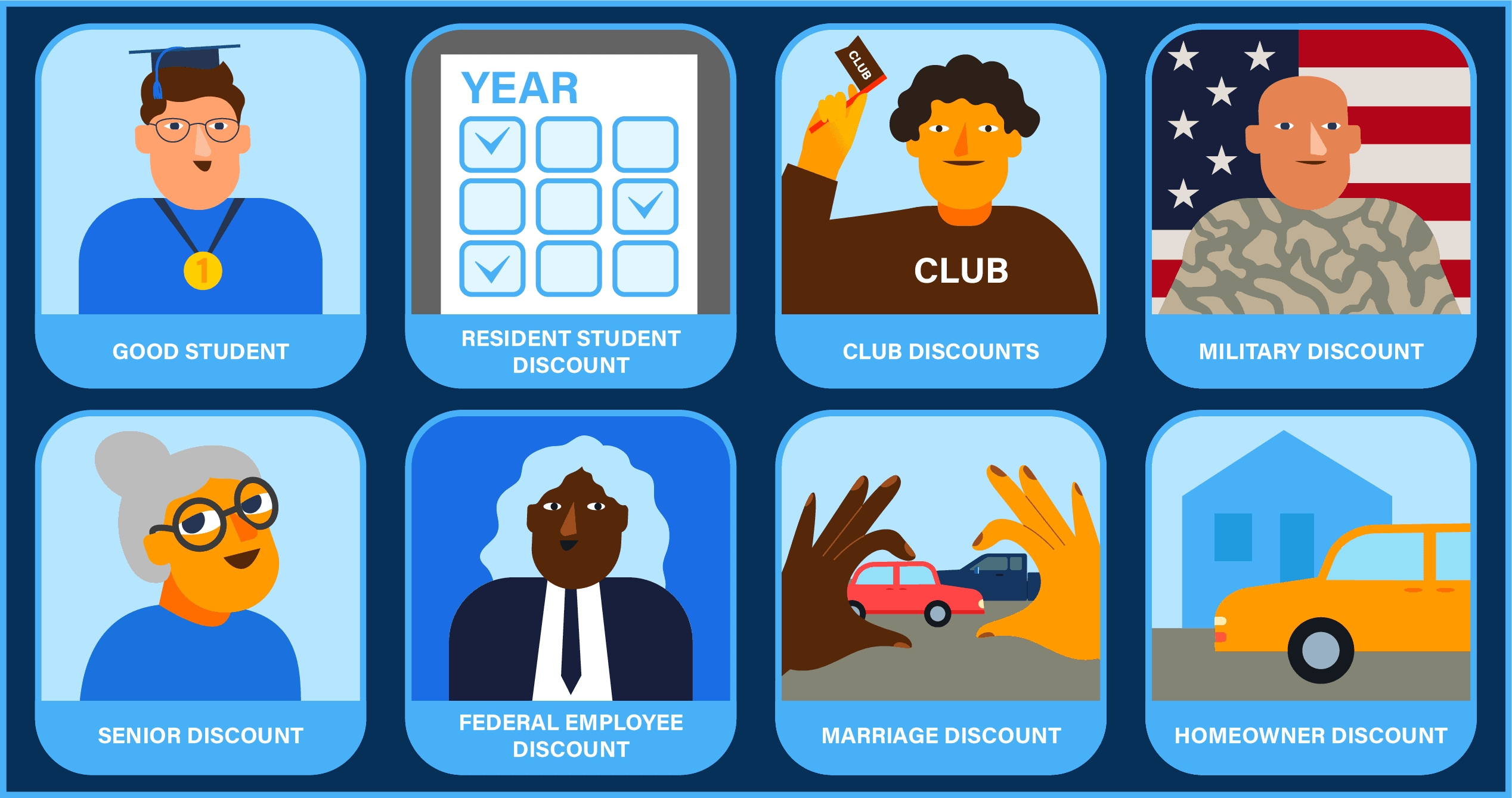

- Take Advantage of Discounts: Inquire about available discounts, such as for safe driving, being a member of certain organizations, or completing defensive driving courses.

Implementing these strategies can lead to substantial savings over time. For instance, removing unnecessary coverage on older vehicles or adjusting coverage for infrequently used property can also cut costs. Additionally, installing safety systems in your home or car can qualify you for further discounts. Remember, it’s important to review your insurance policies regularly to ensure you are still getting the best rate possible. By staying proactive and informed, you can effectively manage your insurance expenses and enjoy peace of mind.

Are You Paying Too Much? Secrets to Lowering Your Insurance Costs

Are you feeling the pinch of rising insurance premiums? Lowering your insurance costs might be easier than you think. Start by reviewing your current policies and comparing them with offers from other providers. A comprehensive comparison allows you to identify mismatches in coverage and premiums. Additionally, consider increasing your deductibles; a higher deductible often leads to lower monthly payments. However, make sure to keep an emergency fund to cover those higher out-of-pocket costs when making a claim.

Another effective strategy is to take advantage of discounts. Many insurers offer reduced rates for bundling policies, maintaining a good driving record, or completing safety courses. Assessing your coverage needs can also lead to significant savings. If you find that you are paying for coverage you don’t need, such as for an aging vehicle, it's time to trim those excess costs. Don’t hesitate to reach out to your insurance agent to discuss your options for optimizing your policy and potentially lowering your expenses.

Understanding the Factors That Influence Your Premiums: Insider Tips

Understanding the factors that influence your premiums is essential for anyone seeking to make informed decisions about their insurance. Various elements play a significant role in determining the cost of your premiums, and among these, your personal risk profile is one of the most impactful. Insurers assess factors such as your age, driving record, and claims history to evaluate your risk level. Additionally, the type of coverage you choose and the deductible amount also significantly affect your premium rates.

To better navigate the complexities of insurance pricing, consider implementing these insider tips:

- Maintain a good credit score: Your credit history can greatly influence your premiums, so keeping a clean record is beneficial.

- Bundle your policies: Many insurers offer discounts for bundling multiple policies, such as home and auto insurance.

- Review your coverage regularly: Periodically reassessing your policies can help ensure you're not paying for unnecessary coverage or missing out on potential discounts.