Unveiling the Secrets of Ghosted Domains

Explore the intriguing world of expired domains and online opportunities.

Travel Insurance: Your Safety Net on the Road to Adventure

Explore the world worry-free! Discover how travel insurance can protect you on your thrilling adventures. Stay safe and travel smart!

Understanding the Basics of Travel Insurance: What You Need to Know

Travel insurance is a vital component of any trip, providing essential coverage for unexpected events that can occur before or during your journey. Whether you’re a seasoned traveler or planning your first vacation, understanding the basics of travel insurance can help you choose the right policy to suit your needs. Typically, travel insurance covers three main areas: trip cancellation, emergency medical expenses, and lost or stolen belongings. For more detailed information on what travel insurance covers, you can visit Insure My Trip.

When selecting a travel insurance plan, it's important to compare different policies and understand the terms and conditions associated with each one. Look for factors such as coverage limits, policy exclusions, and the process for filing claims. Additionally, consider your personal circumstances; for example, if you plan on engaging in activities like skiing or scuba diving, ensure your policy covers those adventures. You can learn more about choosing the right travel insurance by visiting Forbes Advisor.

Top 5 Reasons Why Travel Insurance is Essential for Your Adventures

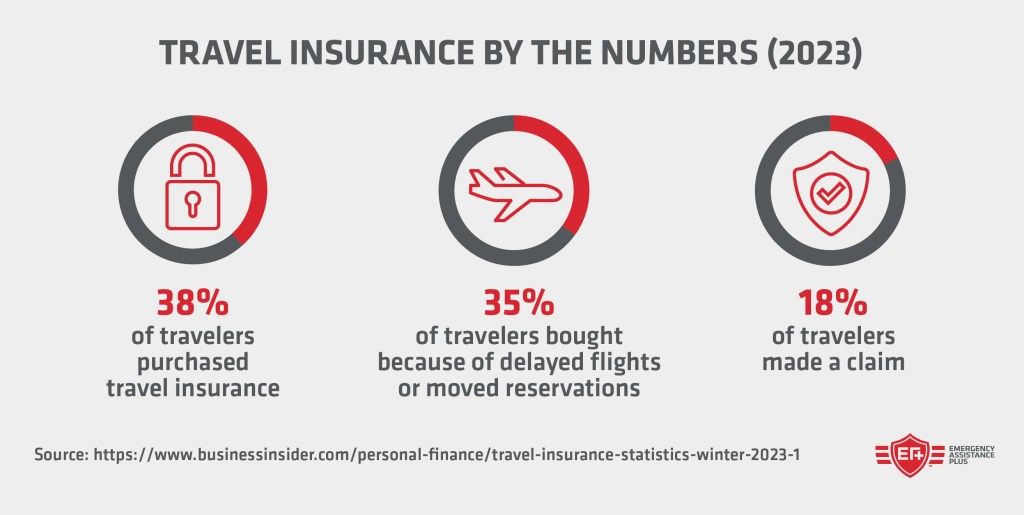

When planning your next adventure, one crucial element that should never be overlooked is travel insurance. With so many unpredictable factors involved in traveling, it serves as a safety net, protecting you from potential financial loss due to unforeseen circumstances. For instance, if you encounter trip cancellations, delayed flights, or lost luggage, having travel insurance can provide you with the necessary support to alleviate stress and avoid hefty expenses. According to the Travel Safe, approximately 1 in 6 travelers experience unexpected issues during their trips, making travel insurance an essential consideration for responsible travelers.

Moreover, travel insurance is vital for healthcare emergencies while abroad. Medical costs can skyrocket in foreign countries, and without adequate coverage, you may be left with overwhelming bills for treatment. Policies often cover medical evacuations, trip interruptions due to medical emergencies, and even repatriation of remains, ensuring that you are taken care of no matter the situation. As highlighted by the Insure My Trip, health-related issues are among the top reasons why travelers file claims, further emphasizing the importance of securing the right insurance before embarking on your journey.

How to Choose the Right Travel Insurance for Your Next Trip

Choosing the right travel insurance for your next trip is crucial for ensuring peace of mind while you explore new destinations. Begin by evaluating your specific needs, such as the duration of your trip, the type of activities you'll engage in, and any pre-existing medical conditions you may have. It's advisable to compare different policies by looking at the NerdWallet's Travel Insurance Guide, which provides insights on various plans.

Once you have a clear understanding of your needs, consider the coverage options each policy offers. A comprehensive travel insurance policy should include medical expenses, trip cancellation, and lost baggage coverage. Don't forget to read customer reviews and check ratings on websites like InsureMyTrip to get a better idea of the insurers' reputation. Finally, pay attention to the policy limits and exclusions to make an informed choice that ensures all your bases are covered.